Sallie Mae 2009 Annual Report Download - page 255

Download and view the complete annual report

Please find page 255 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Lender Partners — Lender Partners are lenders who originate loans under forward purchase commit-

ments under which the Company owns the loans from inception or, in most cases, acquires the loans soon

after origination.

Managed Basis — The Company generally analyzes the performance of its student loan portfolio on a

Managed Basis. The Company views both on-balance sheet student loans and off-balance sheet student loans

owned by the securitization trusts as a single portfolio, and the related on-balance sheet financings are

combined with off-balance sheet debt. When the term Managed is capitalized in this document, it is referring

to Managed Basis.

Private Education Loans — Education loans to students or parents of students that are not guaranteed

under the FFELP. Private Education Loans include loans for higher education (undergraduate and graduate

degrees) and for alternative education, such as career training, private kindergarten through secondary

education schools and tutorial schools. Higher education loans have repayment terms similar to FFELP loans,

whereby repayments begin after the borrower leaves school. The Company’s higher education Private

Education Loans are not dischargeable in bankruptcy, except in certain limited circumstances. Repayment for

alternative education generally begins immediately.

In the context of the Company’s Private Education Loan business, the Company uses the term “non-

traditional loans” to describe education loans made to certain borrowers that have or are expected to have a

high default rate as a result of a number of factors, including having a lower tier credit rating, low program

completion and graduation rates or, where the borrower is expected to graduate, a low expected income

relative to the borrower’s cost of attendance.

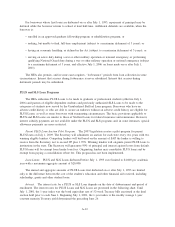

Proposed Merger — On April 16, 2007, the Company announced that a buyer group (“Buyer Group”)

led by J.C. Flowers & Co. (“J.C. Flowers”), Bank of America, N.A. and JPMorgan Chase, N.A. (the

“Merger”) had signed a definitive agreement (“Merger Agreement”) to acquire the Company for approximately

$25.3 billion or $60.00 per share of common stock. (See also “Merger Agreement” filed with the SEC on the

Company’s Current Report on Form 8-K, dated April 18, 2007.) On January 25, 2008, the Company, Mustang

Holding Company Inc. (“Mustang Holding”), Mustang Merger Sub, Inc. (“Mustang Sub”), J.C. Flowers, Bank

of America, N.A. and JPMorgan Chase Bank, N.A. entered into a Settlement, Termination and Release

Agreement (the “Agreement”). Under the Agreement, a lawsuit filed by the Company related to the Merger, as

well as all counterclaims, was dismissed.

Repayment Borrower Benefits — Financial incentives offered to borrowers based on pre-determined

qualifying factors, which are generally tied directly to making on-time monthly payments. The impact of

Repayment Borrower Benefits is dependent on the estimate of the number of borrowers who will eventually

qualify for these benefits and the amount of the financial benefit offered to the borrower. The Company

occasionally changes Repayment Borrower Benefits programs in both amount and qualification factors. These

programmatic changes must be reflected in the estimate of the Repayment Borrower Benefits discount when

made.

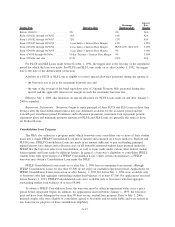

Residual Interest — When the Company securitizes student loans, it retains the right to receive cash

flows from the student loans sold to trusts that it sponsors in excess of amounts needed to pay servicing,

derivative costs (if any), other fees, and the principal and interest on the bonds backed by the student loans.

The Residual Interest, which may also include reserve and other cash accounts, is the present value of these

future expected cash flows, which includes the present value of any Embedded Fixed Rate Floor Income

described above. The Company values the Residual Interest at the time of sale of the student loans to the trust

and as of the end of each subsequent quarter.

Retained Interest — The Retained Interest includes the Residual Interest (defined above) and servicing

rights (as the Company retains the servicing responsibilities) for our securitization transactions accounted for

as sales.

Risk Sharing — When a FFELP loan first disbursed on and after July 1, 2006 defaults, the federal

government guarantees 97 percent of the principal balance plus accrued interest (98 percent on loans disbursed

before July 1, 2006) and the holder of the loan is at risk for the remaining amount not guaranteed as a Risk

G-4