Sallie Mae 2009 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

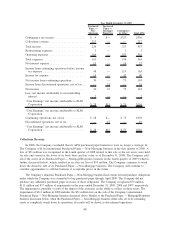

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total On-

Balance Sheet

Portfolio

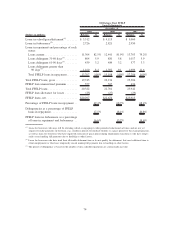

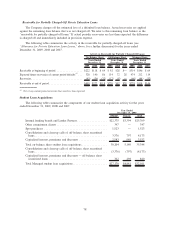

On-Balance Sheet

Year Ended December 31, 2008

Beginning balance . ........................... $35,726 $73,609 $109,335 $14,818 $124,153

Net consolidations:

Incremental consolidations from third parties . . ....... — 462 462 149 611

Consolidations to third parties . . ................. (703) (392) (1,095) (41) (1,136)

Net consolidations . ........................... (703) 70 (633) 108 (525)

Acquisitions ................................ 21,889 1,358 23,247 7,357 30,604

Net acquisitions . . ........................... 21,186 1,428 22,614 7,465 30,079

Internal consolidations

(2)

........................ (409) 529 120 228 348

Off-balance sheet securitizations . . ................. — — — — —

Sales..................................... (522) (26) (548) — (548)

Repayments/claims/other . . ...................... (3,505) (3,796) (7,301) (1,929) (9,230)

Ending balance . . . ........................... $52,476 $71,744 $124,220 $20,582 $144,802

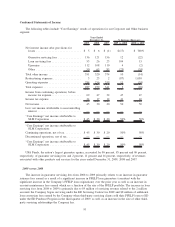

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total Off-

Balance Sheet

Portfolio

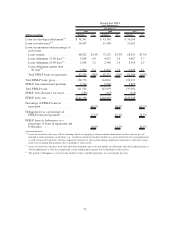

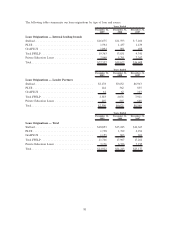

Off-Balance Sheet

Year Ended December 31, 2008

Beginning balance ............................. $9,472 $16,441 $25,913 $13,510 $39,423

Net consolidations:

Incremental consolidations from third parties .......... — — — — —

Consolidations to third parties ................... (311) (83) (394) (57) (451)

Net consolidations ............................. (311) (83) (394) (57) (451)

Acquisitions . . . .............................. 246 211 457 742 1,199

Net acquisitions .............................. (65) 128 63 685 748

Internal consolidations

(2)

......................... (84) (36) (120) (228) (348)

Off-balance sheet securitizations ................... — — — — —

Sales . . ................................... — — — — —

Repayments/claims/other ........................ (2,180) (1,002) (3,182) (1,050) (4,232)

Ending balance . .............................. $7,143 $15,531 $22,674 $12,917 $35,591

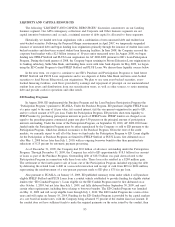

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total

Managed Basis

Portfolio

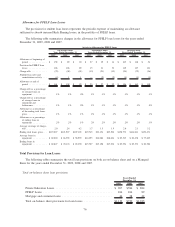

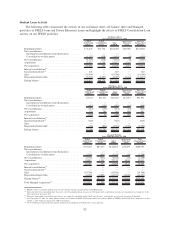

Managed Portfolio

Year Ended December 31, 2008

Beginning balance ........................... $45,198 $90,050 $135,248 $28,328 $163,576

Net consolidations:

Incremental consolidations from third parties ........ — 462 462 149 611

Consolidations to third parties .................. (1,014) (475) (1,489) (98) (1,587)

Net consolidations ........................... (1,014) (13) (1,027) 51 (976)

Acquisitions . . . ............................ 22,135 1,569 23,704 8,099 31,803

Net acquisitions . ............................ 21,121 1,556 22,677 8,150 30,827

Internal consolidations

(2)

....................... (493) 493 — — —

Off-balance sheet securitizations .................. — — — — —

Sales . . . ................................. (522) (26) (548) — (548)

Repayments/claims/other ....................... (5,685) (4,798) (10,483) (2,979) (13,462)

Ending balance

(3)

............................ $59,619 $87,275 $146,894 $33,499 $180,393

Total Managed Acquisitions

(4)

.................... $22,135 $ 2,031 $ 24,166 $ 8,248 $ 32,414

(1)

FFELP category is primarily Stafford Loans but also includes federally guaranteed PLUS and HEAL Loans.

(2)

Represents borrowers consolidating their loans into a new Consolidation Loan. Loans in our off-balance sheet securitization trusts that are consolidated are bought out of the

trusts and moved on-balance sheet.

(3)

As of December 31, 2008, the ending balance includes $13.7 billion of FFELP Stafford and Other Loans and $2.6 billion of FFELP Consolidation Loans disbursed on or after

October 1, 2007, which are impacted by CCRAA legislation.

(4)

The Total Managed Acquisitions line includes incremental consolidations from third parties and acquisitions.

83