Sallie Mae 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

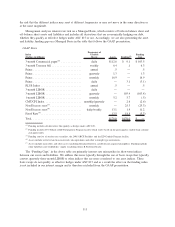

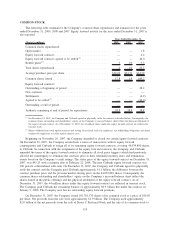

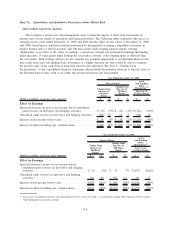

COMMON STOCK

The following table summarizes the Company’s common share repurchases and issuances for the years

ended December 31, 2009, 2008 and 2007. Equity forward activity for the year ended December 31, 2007 is

also reported.

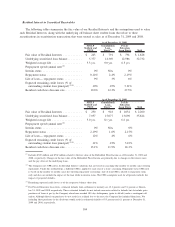

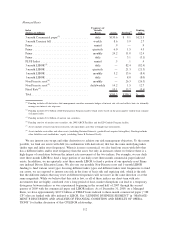

(Shares in millions) 2009 2008 2007

Years Ended December 31,

Common shares repurchased:

Open market ............................................ — — 1.8

Equity forward contracts ................................... — — 4.2

Equity forward contracts agreed to be settled

(1)

.................. — — 44.0

Benefit plans

(2)

.......................................... .3 1.0 3.3

Total shares repurchased ................................... .3 1.0 53.3

Average purchase price per share ............................. $20.29 $24.51 $44.59

Common shares issued .................................... 17.8 1.9 109.2

Equity forward contracts:

Outstanding at beginning of period ........................... — — 48.2

New contracts ........................................... — — —

Settlements ............................................. — — (4.2)

Agreed to be settled

(1)

..................................... — — (44.0)

Outstanding at end of period ................................ — — —

Authority remaining at end of period for repurchases .............. 38.8 38.8 38.8

(1)

On December 31, 2007, the Company and Citibank agreed to physically settle the contract as detailed below. Consequently, the

common shares outstanding and shareholders’ equity on the Company’s year-end balance sheet reflect the physical settlement of

the equity forward contract. As of December 31, 2007, the 44 million shares under this equity forward contract are reflected in

treasury stock.

(2)

Shares withheld from stock option exercises and vesting of restricted stock for employees’ tax withholding obligations and shares

tendered by employees to satisfy option exercise costs.

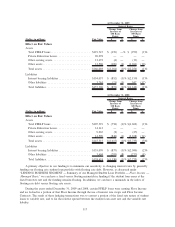

Beginning on November 29, 2007, the Company amended or closed out certain equity forward contracts.

On December 19, 2007, the Company entered into a series of transactions with its equity forward

counterparties and Citibank to assign all of its remaining equity forward contracts, covering 44,039,890 shares,

to Citibank. In connection with the assignment of the equity forward contracts, the Company and Citibank

amended the terms of the equity forward contract to eliminate all stock price triggers (which had previously

allowed the counterparty to terminate the contracts prior to their scheduled maturity date) and termination

events based on the Company’s credit ratings. The strike price of the equity forward contract on December 19,

2007, was $45.25 with a maturity date of February 22, 2008. The new Citibank equity forward contract was

100 percent collateralized with cash. On December 31, 2007, the Company and Citibank agreed to physically

settle the contract and the Company paid Citibank approximately $1.1 billion, the difference between the

contract purchase price and the previous market closing price on the 44,039,890 shares. Consequently, the

common shares outstanding and shareholders’ equity on the Company’s year-end balance sheet reflect the

shares issued in the public offerings and the physical settlement of the equity forward contract. As of

December 31, 2007, the 44 million shares under this equity forward contract are reflected in treasury stock.

The Company paid Citibank the remaining balance of approximately $0.9 billion due under the contract on

January 9, 2008. The Company now has no outstanding equity forward positions.

On December 31, 2007, the Company issued 101,781,170 shares of its common stock at a price of $19.65

per share. Net proceeds from the sale were approximately $1.9 billion. The Company used approximately

$2.0 billion of the net proceeds from the sale of Series C Preferred Stock and the sale of its common stock to

114