Sallie Mae 2009 Annual Report Download - page 253

Download and view the complete annual report

Please find page 253 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ED — The U.S. Department of Education.

Embedded Floor Income — Embedded Floor Income is Floor Income (see definition below) that is

earned on off-balance sheet student loans that are in securitization trusts sponsored by the Company. At the

time of the securitization, the value of Embedded Fixed Rate Floor Income is included in the initial valuation

of the Residual Interest (see definition below) and the gain or loss on sale of the student loans. Embedded

Floor Income is also included in the quarterly fair value adjustments of the Residual Interest.

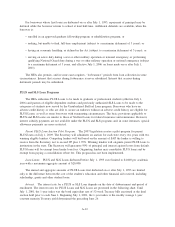

Exceptional Performer (“EP”) — The EP designation is determined by ED in recognition of a servicer

meeting certain performance standards set by ED in servicing FFELP Loans. Upon receiving the EP

designation, the EP servicer receives reimbursement on default claims higher than the legislated Risk Sharing

(see definition below) levels on federally guaranteed student loans for all loans serviced for a period of at

least 270 days before the date of default. The EP servicer is entitled to receive this benefit as long as it

remains in compliance with the required servicing standards, which are assessed on an annual and quarterly

basis through compliance audits and other criteria. The annual assessment is in part based upon subjective

factors which alone may form the basis for an ED determination to withdraw the designation. If the

designation is withdrawn, Risk Sharing may be applied retroactively to the date of the occurrence that resulted

in noncompliance. The College Cost Reduction Act of 2007 (“CCRAA”) eliminated the EP designation

effective October 1, 2007. See also Appendix A, “FEDERAL FAMILY EDUCATION LOAN PROGRAM.”

FFELP — The Federal Family Education Loan Program, formerly the Guaranteed Student Loan

Program.

FFELP Consolidation Loans — Under the FFELP, borrowers with multiple eligible student loans may

consolidate them into a single student loan with one lender at a fixed rate for the life of the loan. The new

loan is considered a FFELP Consolidation Loan. Typically a borrower may consolidate his student loans only

once unless the borrower has another eligible loan to consolidate with the existing FFELP Consolidation Loan.

The borrower rate on a FFELP Consolidation Loan is fixed for the term of the loan and is set by the weighted

average interest rate of the loans being consolidated, rounded up to the nearest 1/8th of a percent, not to

exceed 8.25 percent. In low interest rate environments, FFELP Consolidation Loans provide an attractive

refinancing opportunity to certain borrowers because they allow borrowers to consolidate variable rate loans

into a long-term fixed rate loan. Holders of FFELP Consolidation Loans are eligible to earn interest under the

Special Allowance Payment (“SAP”) formula (see definition below). In April 2008, the Company suspended

originating new FFELP Consolidation Loans.

FFELP Stafford and Other Student Loans — Education loans to students or parents of students that

are guaranteed or reinsured under FFELP. The loans are primarily Stafford loans but also include PLUS and

HEAL loans.

Fixed Rate Floor Income — Fixed Rate Floor Income is Floor Income (see definition below) associated

with student loans with borrower rates that are fixed to term (primarily FFELP Consolidation Loans and

Stafford Loans originated on or after July 1, 2006).

Floor Income — FFELP loans generally earn interest at the higher of either the borrower rate, which is

fixed over a period of time, or a floating rate based on the SAP formula (see definition below). The Company

generally finances its student loan portfolio with floating rate debt whose interest is matched closely to the

floating nature of the applicable SAP formula. If interest rates decline to a level at which the borrower rate

exceeds the SAP formula rate, the Company continues to earn interest on the loan at the fixed borrower rate

while the floating rate interest on our debt continues to decline. In these interest rate environments, the

Company refers to the additional spread it earns between the fixed borrower rate and the SAP formula rate as

Floor Income. Depending on the type of student loan and when it was originated, the borrower rate is either

fixed to term or is reset to a market rate each July 1. As a result, for loans where the borrower rate is fixed to

term, the Company may earn Floor Income for an extended period of time, and for those loans where the

borrower interest rate is reset annually on July 1, the Company may earn Floor Income to the next reset date.

In accordance with legislation enacted in 2006, lenders are required to rebate Floor Income to ED for all

FFELP loans disbursed on or after April 1, 2006.

G-2