Sallie Mae 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

In February 2009, the FASB issued another topic update to ASC 805. This additional update amends the

provisions related to the initial recognition and measurement, subsequent measurement and disclosure of assets

and liabilities arising from contingencies in a business combination under ASC 805. The ASC topic update

had the same effective date as the topic update to ASC 805 referenced above. The adoption of this topic

update did not have a material effect on the Company’s results of operations or financial position.

Noncontrolling Interests in Consolidated Financial Statements

In December 2007, the FASB issued a topic update to ASC 810, “Consolidation.” This update requires

reporting entities to present noncontrolling (minority) interests as equity (as opposed to presentation as a

liability or mezzanine equity) and provides guidance on the accounting for transactions between an entity and

noncontrolling interests. On January 1, 2009, the Company adopted this ASC topic update, the provisions of

which, among other things, require that minority interests be renamed “noncontrolling interests” and that a

company present a consolidated net income (loss) measure that includes the amount attributable to such

“noncontrolling interests” for all periods presented. The topic update to ASC 810 applies prospectively for

reporting periods beginning on or after December 15, 2008, except for the presentation and disclosure

requirements which are applied retrospectively for all periods presented. The Company has reclassified

financial statement line items within its consolidated balance sheets, statements of income, statements of

changes in stockholders’ equity and statements of cash flows for the prior periods to conform to this topic

update. Other than the change in presentation of noncontrolling interests, the adoption of this topic update had

no impact on the consolidated financial statements.

Disclosures about Derivative Investments and Hedging Activities

In March 2008, the FASB updated ASC 815, “Derivatives and Hedging.” This topic update requires

enhanced disclosures about an entity’s derivative and hedging activities, including (1) how and why an entity

uses derivative instruments, (2) how derivative instruments and related hedged items are accounted for under

ASC 815 and its related interpretations, and (3) how derivative instruments and related hedged items affect an

entity’s financial position, financial performance, and cash flows. To meet those objectives, the topic update

requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures

about fair value amounts and gains and losses on derivative instruments, and disclosures about credit-risk-

related contingent features in derivative agreements. This ASC topic update is effective for financial

statements issued for fiscal years and interim periods beginning after November 15, 2008. The Company

adopted this topic update on January 1, 2009.

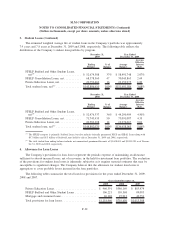

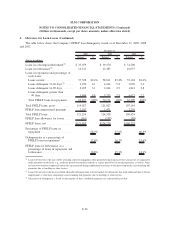

3. Student Loans

The FFELP is subject to comprehensive reauthorization every five years and to frequent statutory and

regulatory changes. The most recent reauthorization of the student loan programs was the Higher Education

Reconciliation Act of 2005 (the “Reconciliation Legislation”).

There are three principal categories of FFELP loans: Stafford, PLUS, and FFELP Consolidation Loans.

Generally, Stafford and PLUS Loans have repayment periods of between five and ten years. FFELP

Consolidation Loans have repayment periods of twelve to thirty years. FFELP loans do not require repayment,

or have modified repayment plans, while the borrower is in-school and during the grace period immediately

upon leaving school. The borrower may also be granted a deferment or forbearance for a period of time based

on need, during which time the borrower is not considered to be in repayment. Interest continues to accrue on

loans in the in-school, deferment and forbearance period. FFELP loans obligate the borrower to pay interest at

a stated fixed rate or a variable rate reset annually (subject to a cap) on July 1 of each year depending on

F-29

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)