Sallie Mae 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Limitations of “Core Earnings”

While GAAP provides a uniform, comprehensive basis of accounting, for the reasons described above,

management believes that “Core Earnings” are an important additional tool for providing a more complete

understanding of the Company’s results of operations. Nevertheless, “Core Earnings” are subject to certain

general and specific limitations that investors should carefully consider. For example, as stated above, unlike

financial accounting, there is no comprehensive, authoritative guidance for management reporting. Our “Core

Earnings” are not defined terms within GAAP and may not be comparable to similarly titled measures

reported by other companies. Unlike GAAP, “Core Earnings” reflect only current period adjustments to GAAP.

Accordingly, the Company’s “Core Earnings” presentation does not represent a comprehensive basis of

accounting. Investors, therefore, may not compare our Company’s performance with that of other financial

services companies based upon “Core Earnings.” “Core Earnings” results are only meant to supplement GAAP

results by providing additional information regarding the operational and performance indicators that are most

closely used by management, the Company’s board of directors, rating agencies and lenders to assess

performance.

Other limitations arise from the specific adjustments that management makes to GAAP results to derive

“Core Earnings” results. For example, in reversing the unrealized gains and losses that result from ASC 815,

“Derivatives and Hedging,” on derivatives that do not qualify for “hedge treatment,” as well as on derivatives

that do qualify but are in part ineffective because they are not perfect hedges, we focus on the long-term

economic effectiveness of those instruments relative to the underlying hedged item and isolate the effects of

interest rate volatility and changing credit spreads on the fair value of such instruments during the period.

Under GAAP, the effects of these factors on the fair value of the derivative instruments (but not on the

underlying hedged item) tend to show more volatility in the short term. While our presentation of our results

on a “Core Earnings” basis provides important information regarding the performance of our Managed

portfolio, a limitation of this presentation is that we are presenting the ongoing spread income on loans that

have been sold to a trust managed by us. While we believe that our “Core Earnings” presentation presents the

economic substance of our Managed loan portfolio, it understates earnings volatility from securitization gains.

Our “Core Earnings” results exclude certain Floor Income, which is real cash income, from our reported

results and therefore may understate earnings in certain periods. Management’s financial planning and

valuation of operating results, however, does not take into account Floor Income because of its inherent

uncertainty, except when it is Fixed Rate Floor Income that is economically hedged through Floor Income

Contracts.

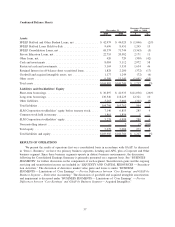

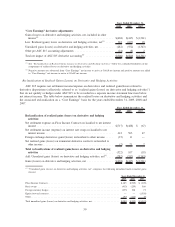

Pre-tax Differences between “Core Earnings” and GAAP by Business Segment

Our “Core Earnings” are the primary financial performance measures used by management to evaluate

performance and to allocate resources. Accordingly, financial information is reported to management on a

“Core Earnings” basis by reportable segment, as these are the measures used regularly by our chief operating

decision makers. Our “Core Earnings” are used in developing our financial plans and tracking results and also

in establishing corporate performance targets and incentive compensation. Management believes this informa-

tion provides additional insight into the financial performance of the Company’s core business activities. “Core

Earnings” net income reflects only current period adjustments to GAAP net income, as described in the more

detailed discussion of the differences between “Core Earnings” and GAAP that follows, which includes further

detail on each specific adjustment required to reconcile our “Core Earnings” segment presentation to our

GAAP earnings.

47