Sallie Mae 2009 Annual Report Download - page 256

Download and view the complete annual report

Please find page 256 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

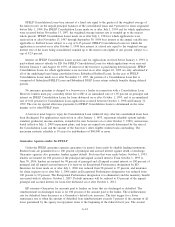

Sharing loss on the loan. FFELP loans originated after October 1, 1993 are subject to Risk Sharing on loan

default claim payments unless the default results from the borrower’s death, disability or bankruptcy. FFELP

loans serviced by a servicer that has Exceptional Performer designation from ED were subject to one-percent

Risk Sharing for claims filed on or after July 1, 2006 and before October 1, 2007. The CCRAA reduces

default insurance to 95 percent of the unpaid principal and accrued interest for loans first disbursed on or after

October 1, 2012.

Special Allowance Payment (“SAP”) — FFELP loans disbursed prior to April 1, 2006 (with the

exception of certain PLUS and SLS loans discussed below) generally earn interest at the greater of the

borrower rate or a floating rate determined by reference to the average of the applicable floating rates (91-day

Treasury bill rate or commercial paper) in a calendar quarter, plus a fixed spread that is dependent upon when

the loan was originated and the loan’s repayment status. If the resulting floating rate exceeds the borrower

rate, ED pays the difference directly to the Company. This payment is referred to as the Special Allowance

Payment or SAP and the formula used to determine the floating rate is the SAP formula. The Company refers

to the fixed spread to the underlying index as the SAP spread. For loans disbursed after April 1, 2006, FFELP

loans effectively only earn at the SAP rate, as the excess interest earned when the borrower rate exceeds the

SAP rate (Floor Income) must be refunded to ED.

Variable rate PLUS Loans and SLS Loans earn SAP only if the variable rate, which is reset annually,

exceeds the applicable maximum borrower rate. For PLUS loans disbursed on or after January 1, 2000, this

limitation on SAP was repealed effective April 1, 2006.

A schedule of SAP rates is set forth on pages A-7 and A-8 of the Company’s 2009 Annual Report on

Form 10-K.

Variable Rate Floor Income — Variable Rate Floor Income is Floor Income that is earned only through

the next reset date. For FFELP Stafford loans whose borrower interest rate resets annually on July 1, the

Company may earn Floor Income or Embedded Floor Income based on a calculation of the difference between

the borrower rate and the then current interest rate (see definitions for capitalized terms, above).

G-5