Sallie Mae 2009 Annual Report Download - page 254

Download and view the complete annual report

Please find page 254 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

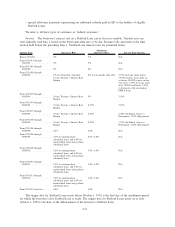

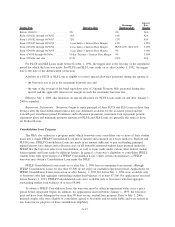

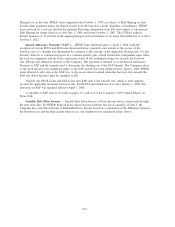

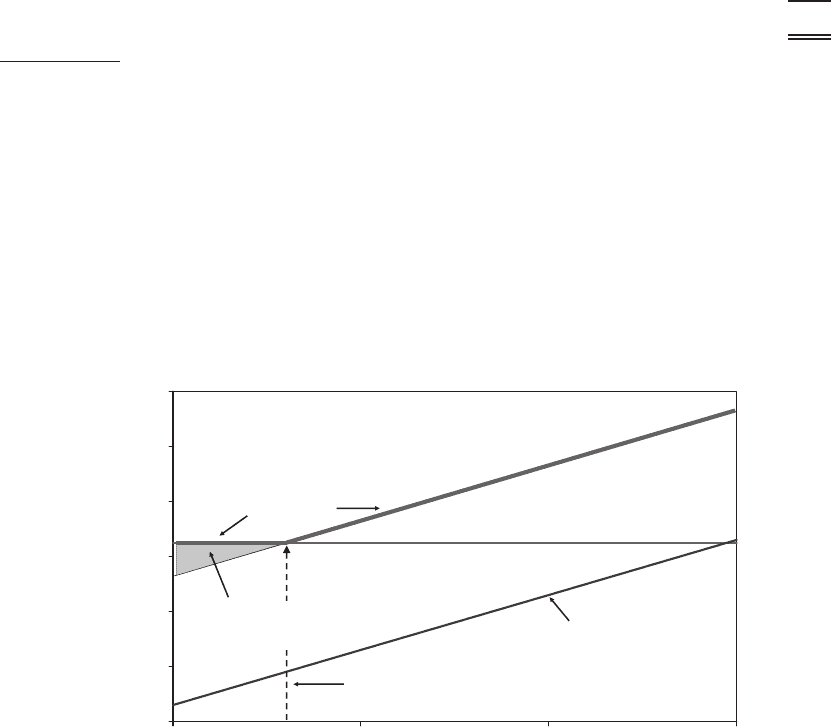

The following example shows the mechanics of Floor Income for a typical fixed rate FFELP Consolida-

tion Loan (with a commercial paper-based SAP spread of 2.64 percent):

Fixed Borrower Rate ...................................................... 7.25%

SAP Spread over Commercial Paper Rate ....................................... (2.64)%

Floor Strike Rate

(1)

....................................................... 4.61%

(1)

The interest rate at which the underlying index (Treasury bill or commercial paper) plus the fixed SAP spread equals the fixed

borrower rate. Floor Income is earned anytime the interest rate of the underlying index declines below this rate.

Based on this example, if the quarterly average commercial paper rate is over 4.61 percent, the holder of

the student loan will earn at a floating rate based on the SAP formula, which in this example is a fixed spread

to commercial paper of 2.64 percent. On the other hand, if the quarterly average commercial paper rate is

below 4.61 percent, the SAP formula will produce a rate below the fixed borrower rate of 7.25 percent and

the loan holder earns at the borrower rate of 7.25 percent.

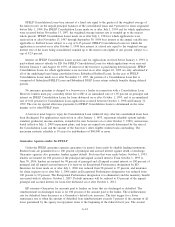

Graphic Depiction of Floor Income:

4.00%

5.00%

6.00%

7.00%

8.00%

9.00%

10.00%

4.00% 5.00% 6.00% 7.00%

Commercial Paper Rate

Floor Strike Rate @ 4.61%

Lender Yield

Floor Income

Fixed Borrower Rate = 7.25%

Special Allowance Payment (SAP) Rate = 2.64%

Floating Debt Rate

Fixed Borrower Rate

Y

ield

Floor Income Contracts — The Company enters into contracts with counterparties under which, in

exchange for an upfront fee representing the present value of the Floor Income that the Company expects to

earn on a notional amount of underlying student loans being economically hedged, the Company will pay the

counterparties the Floor Income earned on that notional amount over the life of the Floor Income Contract.

Specifically, the Company agrees to pay the counterparty the difference, if positive, between the fixed

borrower rate less the SAP (see definition below) spread and the average of the applicable interest rate index

on that notional amount, regardless of the actual balance of underlying student loans, over the life of the

contract. The contracts generally do not extend over the life of the underlying student loans. This contract

effectively locks in the amount of Floor Income the Company will earn over the period of the contract. Floor

Income Contracts are not considered effective hedges under ASC 815, “Derivatives and Hedging,” and each

quarter the Company must record the change in fair value of these contracts through income.

Gross Floor Income — Floor Income earned before payments on Floor Income Contracts.

Guarantor(s) — State agencies or non-profit companies that guarantee (or insure) FFELP loans made by

eligible lenders under The Higher Education Act of 1965 (“HEA”), as amended.

G-3