Sallie Mae 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 1A. Risk Factors

Our business activities involve a variety of risks. Below we describe the significant risk factors affecting our

business. The risks described below are not the only risks facing us — other risks also could impact our business.

Funding and Liquidity.

Our business is affected by funding constraints in the credit market and dependence on various govern-

ment funding sources, and the interest rate characteristics of our earning assets do not always match the

interest rate characteristics of our funding arrangements. These factors may increase the price of or

decrease our ability to obtain liquidity as well expose us to basis risk and repricing.

The capital markets are experiencing a prolonged period of volatility. This volatility has had varying

degrees of impact on most financial organizations. These conditions have impacted the Company’s access to

and cost of capital necessary to manage our business. Additional factors that could make financing difficult,

more expensive or unavailable on any terms include, but are not limited to, financial results and losses of the

Company, changes within our organization, events that have an adverse impact on our reputation, changes in

the activities of our business partners, events that have an adverse impact on the financial services industry,

counterparty availability, changes affecting our assets, corporate and regulatory actions, absolute and compar-

ative interest rate changes, ratings agencies’ actions, general economic conditions and the legal, regulatory,

accounting and tax environments governing our funding transactions.

Our business is also affected by various government funding sources and funding constraints in the capital

markets.

Funding for new FFELP loan originations is currently dependent to a large degree on financial programs

established by the federal government. These programs are described in the “LIQUIDITY AND CAPITAL

RESOURCES” section of this Form 10-K. These federal programs are not permanent and may not be extended

past their expiration dates. There is no assurance that the capital markets will be able to totally support FFELP

loan originations beyond the time these programs are presently scheduled to end. Upon termination of the

government programs mentioned, if cost effective funding sources were not available, we could be compelled

to reduce or suspend the origination of new FFELP loans.

FFELP loans originated under the government programs mentioned above must be re-financed or sold to

the government by a date determined under the terms of the programs. It is our intention to sell these loans to

the government under the terms of the programs.

During 2009, the Company funded private, non-federally guaranteed loan originations primarily through

term brokered deposits raised by Sallie Mae Bank. Assets funded in this manner result in re-financing risk

because the average term of the deposits is shorter than the expected term of some of the same assets. There is

no assurance that this or other sources of funding, such as the term asset-backed securities market, will be

available at a level and a cost that makes new Private Education Loan originations possible or profitable, nor

is there any assurance that the loans can be re-financed at profitable margins.

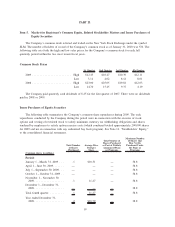

At some time, the Company may decide that it is prudent or necessary to raise additional equity capital

through the sale of common stock, preferred stock, or securities that convert into common stock. There are no

restrictions on entering into the sale of any equity securities in either public or private transactions, except that any

private transaction involving more than 20 percent of shares outstanding requires shareholder approval and any

holder owning more than 10 percent of our fully diluted shares requires approval of the FDIC relating to a change

of control of our Bank. Under current market conditions, the terms of an equity transaction may subject existing

security holders to potential subordination or dilution and may involve a change in governance.

The interest rate characteristics of our earning assets do not always match the interest rate characteristics of

our funding arrangements. This mismatch exposes us to risk in the form of basis risk and repricing risk. While

most of such basis risks are hedged using interest rate swap contracts, such hedges are not always perfect matches

and, therefore, may result in losses. While the asset and hedge indices are short-term with rate movements that are

typically highly correlated, there can be no assurance that the historically high correlation will not be disrupted by

capital market dislocations or other factors not within our control. For instance, as a result of the turmoil in the

capital markets, the historically tight spread between CP and LIBOR began to widen dramatically in the fourth

11