Sallie Mae 2009 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

(credit cards, mortgages). As a result of the economy, provision expense has remained elevated since the

fourth quarter of 2008. If the economy weakens beyond the Company’s expectations, the expected losses

resulting from its default and collection estimates embedded in the allowance could be higher than currently

projected.

As part of concluding on the adequacy of the allowance for loan loss, the Company also reviews key

allowance and loan metrics. The most relevant of these metrics considered are the allowance coverage of

charge-offs ratio; the allowance as a percentage of total loans and of loans in repayment; and delinquency and

forbearance percentages.

In 2009, the Company implemented a program which offers loan modifications to borrowers who qualify.

Temporary interest rate concessions are granted to borrowers experiencing financial difficulties and who meet

other criteria. The allowance on these loans is calculated based on the present value of the expected cash

flows (including estimates of future defaults) discounted at the loan’s effective interest rate. This calculation

contains estimates which are inherently subjective and are evaluated on a periodic basis.

The majority of the Company’s Private Education Loan programs do not require that borrowers begin

repayment until six months after they have graduated or otherwise left school. Consequently, the Company’s

loss estimates for these programs are generally low while the borrower is in school. At December 31, 2009,

37 percent of the principal balance in the higher education Private Education Loan portfolio was related to

borrowers who are in in-school or grace status and not required to make payments. As the current portfolio

ages, an increasing percentage of the borrowers will leave school and be required to begin payments on their

loans. The allowance for losses will change accordingly.

Similar to the rules governing FFELP payment requirements, the Company’s collection policies allow for

periods of nonpayment for borrowers requesting additional payment grace periods upon leaving school or

experiencing temporary difficulty meeting payment obligations. This is referred to as forbearance status and is

considered separately in the Company’s allowance for loan losses. The loss confirmation period is in

alignment with the Company’s typical collection cycle and takes into account these periods of nonpayment.

In general, Private Education Loan principal is charged off against the allowance when the loan exceeds

212 days delinquency. The charge-off amount equals the estimated loss of the defaulted loan balance. Actual

recoveries, as they are received, are applied against the remaining loan balance that was not charged-off. If

periodic recoveries are less than originally expected, the difference results in immediate additional provision

expense and charge-off of such amount.

FFELP loans are guaranteed as to their principal and accrued interest in the event of default subject to a

Risk Sharing level set based on the date of loan disbursement. For loans disbursed after October 1, 1993, and

before July 1, 2006, the Company receives 98 percent reimbursement on all qualifying default claims. For

loans disbursed on or after July 1, 2006, the Company receives 97 percent reimbursement. The College Cost

Reduction and Access Act of 2007 (“CCRAA”) reduces the Risk Sharing level for loans disbursed on or after

October 1, 2012 to 95 percent reimbursement, which will impact the allowance for loan losses in the future.

Similar to the allowance for Private Education Loan losses, the allowance for FFELP loan losses uses

historical experience of borrower default behavior and a two year loss confirmation period to estimate the

credit losses incurred in the loan portfolio at the reporting date. The Company divides the portfolio into

categories of similar risk characteristics based on loan program type, school type and loan status. The

Company then applies the default rate projections, net of applicable Risk Sharing, to each category for the

current period to perform its quantitative calculation. Once the quantitative calculation is performed,

F-15

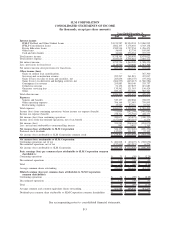

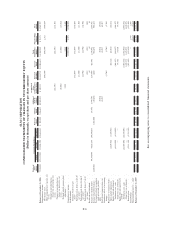

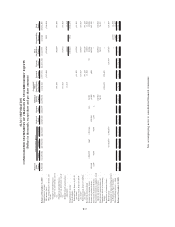

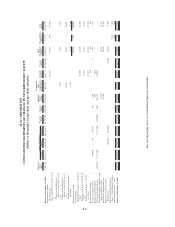

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)