Sallie Mae 2009 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

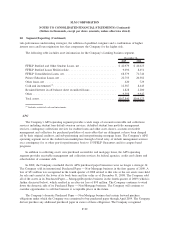

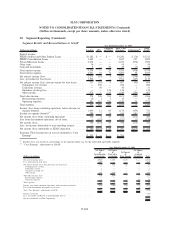

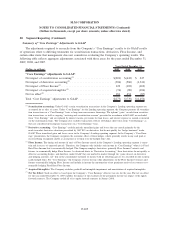

20. Segment Reporting (Continued)

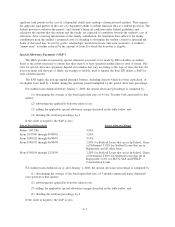

Summary of “Core Earnings” Adjustments to GAAP

The adjustments required to reconcile from the Company’s “Core Earnings” results to its GAAP results

of operations relate to differing treatments for securitization transactions, derivatives, Floor Income, and

certain other items that management does not consider in evaluating the Company’s operating results. The

following table reflects aggregate adjustments associated with these areas for the years ended December 31,

2009, 2008, and 2007.

(Dollars in millions) 2009 2008 2007

Years Ended December 31,

“Core Earnings” adjustments to GAAP:

Net impact of securitization accounting

(1)

....................... $(201) $(442) $ 247

Net impact of derivative accounting

(2)

.......................... (306) (560) (1,341)

Net impact of Floor Income

(3)

................................ 129 (102) (169)

Net impact of acquired intangibles

(4)

........................... (76) (89) (106)

Net tax effect

(5)

.......................................... 181 454 (87)

Total “Core Earnings” adjustments to GAAP ..................... $(273) $(739) $(1,456)

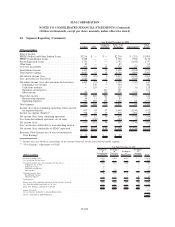

(1)

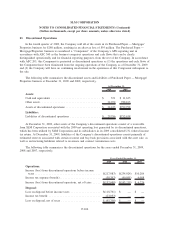

Securitization accounting: Under GAAP, certain securitization transactions in the Company’s Lending operating segment are

accounted for as sales of assets. Under “Core Earnings” for the Lending operating segment, the Company presents all securitiza-

tion transactions on a “Core Earnings” basis as long-term non-recourse financings. The upfront “gains” on sale from securitiza-

tion transactions, as well as ongoing “servicing and securitization revenue” presented in accordance with GAAP, are excluded

from “Core Earnings” and are replaced by interest income, provisions for loan losses, and interest expense as earned or incurred

on the securitization loans. The Company also excludes transactions with its off-balance sheet trusts from “Core Earnings” as

they are considered intercompany transactions on a “Core Earnings” basis.

(2)

Derivative accounting: “Core Earnings” exclude periodic unrealized gains and losses that are caused primarily by the

mark-to-market derivative valuations prescribed by ASC 815 on derivatives that do not qualify for “hedge treatment” under

GAAP. These unrealized gains and losses occur in the Company’s Lending operating segment. In the Company’s “Core Earn-

ings” presentation, the Company recognizes the economic effect of these hedges, which generally results in any cash paid or

received being recognized ratably as an expense or revenue over the hedged item’s life.

(3)

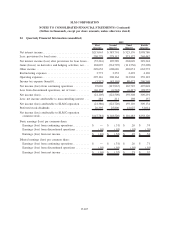

Floor Income: The timing and amount (if any) of Floor Income earned in the Company’s Lending operating segment is uncer-

tain and in excess of expected spreads. Therefore, the Company only includes such income in “Core Earnings” when it is Fixed

Rate Floor Income that is economically hedged. The Company employs derivatives, primarily Floor Income Contracts and

futures, to economically hedge Floor Income. As discussed above in “Derivative Accounting,” these derivatives do not qualify as

effective accounting hedges, and therefore, under GAAP, they are marked-to-market through the “gains (losses) on derivative

and hedging activities, net” line in the consolidated statement of income with no offsetting gain or loss recorded for the econom-

ically hedged items. For “Core Earnings,” the Company reverses the fair value adjustments on the Floor Income Contracts and

futures economically hedging Floor Income and include in income the amortization of net premiums received on contracts eco-

nomically hedging Fixed Rate Floor Income.

(4)

Acquired Intangibles: The Company excludes goodwill and intangible impairment and amortization of acquired intangibles.

(5)

Net Tax Effect: Such tax effect is based upon the Company’s “Core Earnings” effective tax rate for the year. The net tax effect

for the year ended December 31, 2007 includes the impact of the exclusion of the permanent income tax impact of the equity

forward contracts. The Company settled all of its equity forward contracts in January 2008.

F-105

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)