Sallie Mae 2009 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

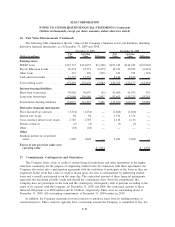

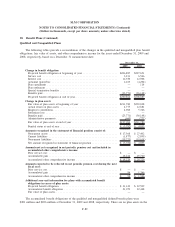

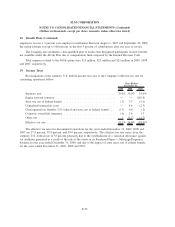

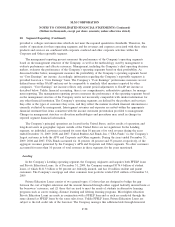

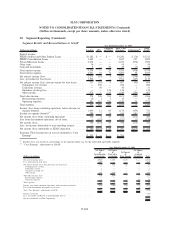

19. Income Taxes (Continued)

At December 31, 2009 and 2008, the tax effect of temporary differences that give rise to deferred tax

assets and liabilities include the following:

2009 2008

December 31,

Deferred tax assets:

Loan reserves .......................................... $ 737,762 $1,212,653

Market value adjustments on student loans, investments and

derivatives ........................................... 496,101 174,276

Deferred revenue ........................................ 83,042 70,172

Stock-based compensation plans ............................. 70,528 62,325

Accrued expenses not currently deductible ..................... 47,249 38,330

Purchased paper impairments ............................... 42,892 111,924

Operating loss and credit carryovers .......................... 36,747 28,293

Unrealized investment losses ............................... 25,949 42,838

Warrants issuance ....................................... 19,716 27,160

Other................................................. 32,717 87,954

Total deferred tax assets ................................... 1,592,703 1,855,925

Deferred tax liabilities:

Gains/(losses) on repurchased debt ........................... 187,505 —

Securitization transactions . . ............................... 93,254 302,049

Leases ................................................ 64,246 73,570

Other................................................. 37,170 12,883

Total deferred tax liabilities . ............................... 382,175 388,502

Net deferred tax assets .................................... $1,210,528 $1,467,423

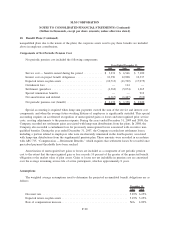

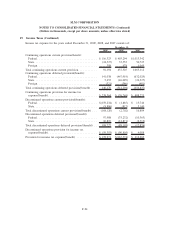

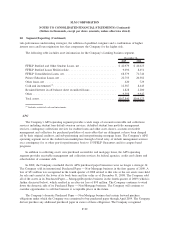

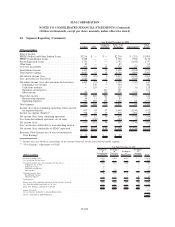

Included in other deferred tax assets is a valuation allowance of $25,111 and $4,901 as of December 31,

2009 and 2008, respectively, against a portion of the Company’s federal, state and international deferred tax

assets. The valuation allowance is primarily attributable to deferred tax assets for federal and state capital loss

carryovers and state net operating loss carryovers that management believes it is more likely than not will

expire prior to being realized. The change in the valuation allowance primarily resulted from the sale of the

assets in its Purchased Paper-Mortgage/Properties business. The ultimate realization of the deferred tax assets

is dependent upon the generation of future taxable income of the appropriate character (i.e. capital or ordinary)

during the period in which the temporary differences become deductible. Management considers, among other

things, the economic slowdown, any impacts if SAFRA or the Community Proposal are passed, the scheduled

reversals of deferred tax liabilities, and the history of positive taxable income available for net operating loss

carrybacks in evaluating the realizability of the deferred tax assets.

As of December 31, 2009, the Company has federal net operating loss carryforwards of $21,020 which

begin to expire in 2022, apportioned state net operating loss carryforwards of $89,958 which begin to expire

in 2010, federal and state capital loss carryovers of $44,289 which begin to expire in 2012, and federal and

state credit carryovers of $1,845 which begin to expire in 2021.

F-95

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)