Sallie Mae 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

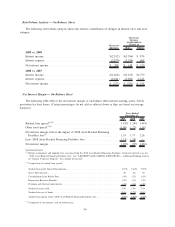

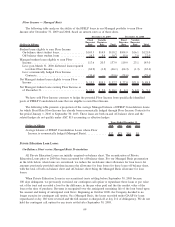

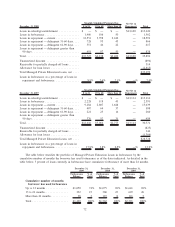

Floor Income — Managed Basis

The following table analyzes the ability of the FFELP loans in our Managed portfolio to earn Floor

Income after December 31, 2009 and 2008, based on interest rates as of those dates.

(Dollars in billions)

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

Fixed

Borrower

Rate

Variable

Borrower

Rate Total

December 31, 2009 December 31, 2008

Student loans eligible to earn Floor Income:

On-balance sheet student loans ................ $103.3 $14.9 $118.2 $104.9 $16.1 $121.0

Off-balance sheet student loans ............... 14.3 5.4 19.7 15.0 7.0 22.0

Managed student loans eligible to earn Floor

Income ................................. 117.6 20.3 137.9 119.9 23.1 143.0

Less: post-March 31, 2006 disbursed loans required

to rebate Floor Income .................... (64.9) (1.2) (66.1) (64.3) (1.3) (65.6)

Less: economically hedged Floor Income

Contracts .............................. (39.6) — (39.6) (28.6) — (28.6)

Net Managed student loans eligible to earn Floor

Income ................................. $ 13.1 $19.1 $ 32.2 $ 27.0 $21.8 $ 48.8

Net Managed student loans earning Floor Income as

of December 31, .......................... $ 13.1 $ 3.0 $ 16.1 $ 4.3 $ 4.8 $ 9.1

We have sold Floor Income contracts to hedge the potential Floor Income from specifically identified

pools of FFELP Consolidation Loans that are eligible to earn Floor Income.

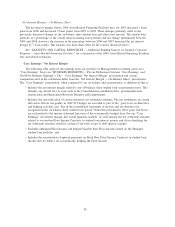

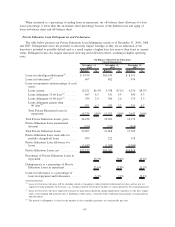

The following table presents a projection of the average Managed balance of FFELP Consolidation Loans

for which Fixed Rate Floor Income has already been economically hedged through Floor Income Contracts for

the period January 1, 2010 to September 30, 2013. These loans are both on-and off-balance sheet and the

related hedges do not qualify under ASC 815 accounting as effective hedges.

(Dollars in billions) 2010 2011 2012 2013

Years Ended December 31,

Average balance of FFELP Consolidation Loans whose Floor

Income is economically hedged (Managed Basis)............. $37 $25 $16 $5

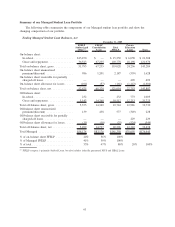

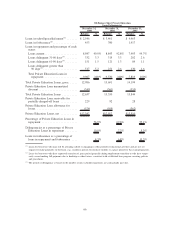

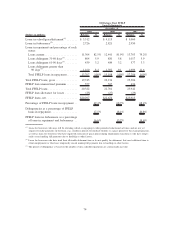

Private Education Loan Losses

On-Balance Sheet versus Managed Basis Presentation

All Private Education Loans are initially acquired on-balance sheet. The securitization of Private

Education Loans prior to 2009 has been accounted for off-balance sheet. For our Managed Basis presentation

in the table below, when loans are securitized, we reduce the on-balance sheet allowance for loan losses for

amounts previously provided and then increase the allowance for loan losses for these loans off-balance sheet,

with the total of both on-balance sheet and off-balance sheet being the Managed Basis allowance for loan

losses.

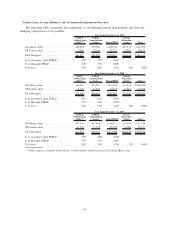

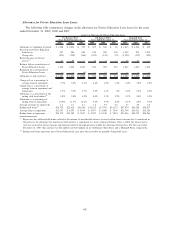

When Private Education Loans in our securitized trusts settling before September 30, 2005 became

180 days delinquent, we previously exercised our contingent call option to repurchase these loans at par value

out of the trust and recorded a loss for the difference in the par value paid and the fair market value of the

loan at the time of purchase. Revenue is recognized over the anticipated remaining life of the loan based upon

the amount and timing of anticipated cash flows. Beginning in October 2008, the Company decided to no

longer exercise its contingent call option. On a Managed Basis, the losses recorded under GAAP for loans

repurchased at day 180 were reversed and the full amount is charged-off at day 212 of delinquency. We do not

hold the contingent call option for any trusts settled after September 30, 2005.

64