Sallie Mae 2009 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

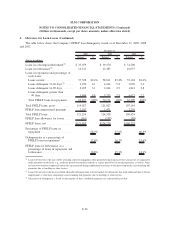

Fair Value Measurements

In January 2010, the FASB issued a topic update to ASC 820, “Fair Value Measurements and

Disclosures.” The update improves reporting by requiring separate disclosures of the amounts of significant

transfers in and out of Level 1 and 2 of fair value measurements and a description of the reasons for the

transfers. In addition, a reporting unit should report separately information about purchases, sales, issuances,

and settlements within the reconciliation of activity in Level 3 fair value measurements. Finally, the update

clarifies existing disclosure requirements regarding the level of disaggregation in reporting classes of assets

and liabilities and discussion of the inputs and valuation techniques used for level 2 and 3 fair values. This

topic update is effective for annual and interim periods beginning January 1, 2010, except for disclosures

about purchases, sales, issuances, and settlements in the roll forward of activity in Level 3 fair value

measurements. Those disclosures are effective for annual and interim periods beginning January 1, 2011.

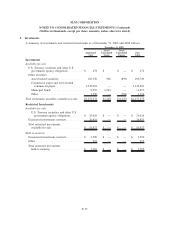

In August 2009, the FASB issued another topic update to ASC 820. The update provides clarification for

the valuation of liabilities when a quoted price in an active market for the liability does not exist and clarifies

that a quoted price for the liability when traded as an asset (when no adjustments are required) is a Level 1

fair value measurement. In addition, it also clarifies that an entity is not required to adjust the value of a

liability for the existence of a restriction that prevents the transfer of the liability. This topic update was

effective for the Company beginning October 1, 2009 and was not material to the Company.

On April 9, 2009, the FASB issued three ASC topic updates regarding fair value measurements and

impairment. Under ASC 320, “Investments — Debt and Equity Securities,” impairment must be recorded

within the consolidated statements of income for debt securities if there exists a fair value loss and the entity

intends to sell the security or it is more likely than not the entity will be required to sell the security before

recovery of the loss. Additionally, expected credit losses must be recorded through income regardless of the

impairment determination above. Remaining fair value losses are recorded to other comprehensive income.

ASC 825, “Financial Instruments,” requires interim disclosures of the fair value of financial instruments that

were previously only required annually. Finally, the topic update to ASC 820 provides guidance for

determining when a significant decrease in market activity has occurred and when a transaction is not orderly.

It further reiterates that prices from inactive markets or disorderly transactions should carry less weight, if any,

to the determination of fair value. These topic updates were effective for the Company beginning April 1,

2009. The adoption of these topic updates was not material to the Company.

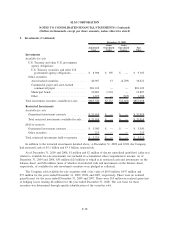

Business Combinations

In December 2007, the FASB issued a topic update to ASC 805, “Business Combinations.” The update

requires the acquiring entity in a business combination to recognize the entire acquisition-date fair value of

assets acquired and liabilities assumed in both full and partial acquisitions; changes the recognition of assets

acquired and liabilities assumed related to contingencies; changes the recognition and measurement of

contingent consideration; requires expensing of most transaction and restructuring costs; and requires

additional disclosures to enable the users of the financial statements to evaluate and understand the nature and

financial effect of the business combination. The ASC 805 topic update applies to all transactions or other

events in which the Company obtains control of one or more businesses. The ASC topic update applies

prospectively to business combinations for which the acquisition date is on or after the beginning of the

reporting period beginning on or after December 15, 2008, which for the Company was January 1, 2009. The

adoption of this topic update on January 1, 2009 did not have a material effect on the Company’s results of

operations or financial position.

F-28

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)