Sallie Mae 2009 Annual Report Download - page 180

Download and view the complete annual report

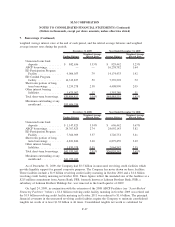

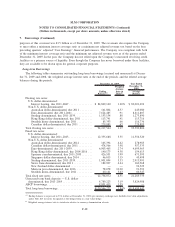

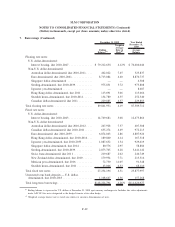

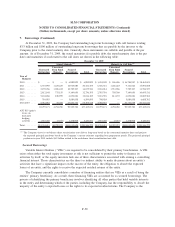

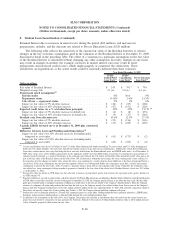

Please find page 180 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Borrowings (Continued)

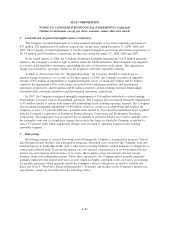

The Department of Education (“ED”) Funding Programs

In August 2008, ED implemented the Purchase Program and the Loan Purchase Participation Program

(the “Participation Program”) pursuant to ECASLA. Under the Purchase Program, ED purchases eligible

FFELP loans at a price equal to the sum of (i) par value, (ii) accrued interest, (iii) the one-percent origination

fee paid to ED, and (iv) a fixed amount of $75 per loan. Under the Participation Program, ED provides short-

term liquidity to FFELP lenders by purchasing participation interests in pools of FFELP loans. FFELP lenders

are charged a rate equal to the preceding quarter commercial paper rate plus 0.50 percent on the principal

amount of participation interests outstanding. Under the terms of the Participation Program, on September 30,

2010, AY 2009-2010 loans funded under the Participation Program must be either repurchased by the

Company or sold to ED pursuant to the Participation Program, which has identical economics to the Purchase

Program. Given the state of the credit markets, the Company currently expect to sell all of the loans it funds

under the Participation Program to ED. Loans eligible for the Participation or Purchase Programs are limited

to FFELP Stafford or PLUS Loans, first disbursed on or after May 1, 2008 but no later than July 1, 2010,

with no ongoing borrower benefits other than permitted rate reductions of 0.25 percent for automatic payment

processing.

As of December 31, 2009, the Company had $9.0 billion of advances outstanding under the Participation

Program. Through December 31, 2009, the Company has sold to ED approximately $18.5 billion face amount

of loans as part of the Purchase Program. Outstanding debt of $18.5 billion was paid down related to the

Participation Program in connection with these loan sales. These loan sales resulted in a $284 million gain.

The settlement of the fourth quarter sale of loans out of the Participation Program included repaying the debt

by delivering the related loans to ED in a non-cash transaction and receipt of cash from ED for $484 million,

representing the reimbursement of a of one-percent payment made to ED plus a $75 fee per loan.

Also pursuant to ECASLA, on January 15, 2009, ED published summary terms under which it will

purchase eligible FFELP Stafford and PLUS Loans from a conduit vehicle established to provide funding for

eligible student lenders (the “ED Conduit Program”). Loans eligible for the ED Conduit Program must be first

disbursed on or after October 1, 2003, but not later than July 1, 2009, and fully disbursed before September 30,

2009, and meet certain other requirements, including those relating to borrower benefits. The ED Conduit

Program was launched on May 11, 2009 and will accept eligible loans through July 1, 2010. The ED Conduit

Program has a term of five years and will expire on January 19, 2014. Funding for the ED Conduit Program is

provided by the capital markets at a cost based on market rates, with the Company being advanced 97 percent

of the student loan face amount. If the conduit does not have sufficient funds to make the required payments

on the notes issued by the conduit, then the notes will be repaid with funds from the Federal Financing Bank

(“FFB”). The FFB will hold the notes for a short period of time and if at the end of that time the notes still

cannot be paid off, the underlying FFELP loans that serve as collateral to the ED Conduit will be sold to ED

through the Put Agreement at a price of 97 percent of the face amount of the loans. As of December 31,

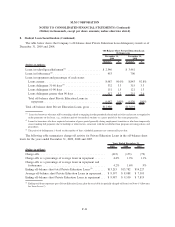

2009, approximately $14.6 billion face amount of the Company’s Stafford and PLUS Loans were funded

through the ED Conduit Program. For 2009, the average interest rate paid on this facility was approximately

0.75 percent. As of December 31, 2009, there are approximately $820 million face amount of additional

FFELP Stafford and PLUS Loans (excluding loans currently in the Participation Program) that can be funded

through the ED Conduit Program.

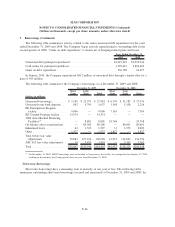

Securitizations

In 2009, the Company completed four FFELP long-term ABS transactions totaling $5.9 billion. The

FFELP transactions were composed primarily of FFELP Consolidation Loans which were not eligible for the

ED Conduit Program or the Term Asset-Backed Securities Loan Facility (“TALF”) discussed below.

F-53

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)