Sallie Mae 2009 Annual Report Download - page 153

Download and view the complete annual report

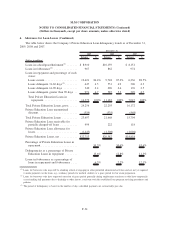

Please find page 153 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

Statement of Cash Flows

Included in the Company’s financial statements is the consolidated statement of cash flows. It is the

policy of the Company to include all derivative net settlements, irrespective of whether the derivative is a

qualifying hedge, in the same section of the statement of cash flows that the derivative is economically

hedging.

As discussed above under “Restricted Cash and Investments,” the Company’s restricted cash balances

primarily relate to on-balance sheet securitizations. This balance is primarily the result of timing differences

between when principal and interest is collected on the trust assets and when principal and interest is paid on

the trust liabilities. As such, changes in this balance are reflected in investing activities.

Reclassifications

Certain reclassifications have been made to the balances as of and for the years ended December 31,

2008 and 2007, to be consistent with classifications adopted for 2009, which had no impact on net income,

total assets or total liabilities.

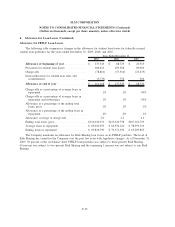

Recently Issued Accounting Standards

FASB Accounting Standards Codification

The Company adopted, as of July 1, 2009, the FASB’s Accounting Standards Codification (“ASC”) as the

source of authoritative accounting principles recognized by the FASB to be applied by nongovernmental

entities in the preparation of financial statements in conformity with GAAP. The ASC does not change

authoritative guidance. Accordingly, implementing the ASC did not change any of the Company’s accounting

and, therefore, did not have an impact on the consolidated results of the Company. References to authoritative

GAAP literature have been updated accordingly.

Transfers of Financial Assets and the Variable Interest Entity (“VIE”) Consolidation Model

In June 2009, the FASB issued topic updates to ASC 860, “Transfers and Servicing,” and to ASC 810,

“Consolidation.”

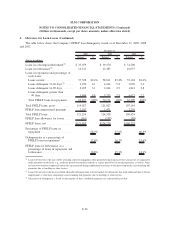

The topic update to ASC 860, among other things, (1) eliminates the concept of a Qualifying Special

Purpose Entity (“QSPE”), (2) changes the requirements for derecognizing financial assets, (3) changes the

amount of the recognized gain/loss on a transfer accounted for as a sale when beneficial interests are received

by the transferor, and (4) requires additional disclosure. The topic update to ASC 860 is effective for

transactions which occur in fiscal years beginning after November 15, 2009. The impact of ASC 860 to future

transactions will depend on how such transactions are structured. ASC 860 relates primarily to the Company’s

secured borrowing facilities. All of the Company’s secured borrowing facilities entered into in 2008 and 2009,

including securitization trusts, have been accounted for as on balance sheet financing facilities. These

transactions would have been accounted for in the same manner if ASC 860 had been effective during these

years.

The topic update to ASC 810 significantly changes the consolidation model for Variable Interest Entities

(“VIEs”). The topic update amends ASC 810 and, among other things, (1) eliminates the exemption for

QSPEs, (2) provides a new approach for determining who should consolidate a VIE that is more focused on

control rather than economic interest, (3) changes when it is necessary to reassess who should consolidate a

VIE and (4) requires additional disclosure. The topic update to ASC 810 is effective for the first annual

reporting period beginning after November 15, 2009.

F-26

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)