Sallie Mae 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

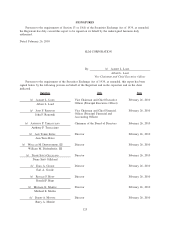

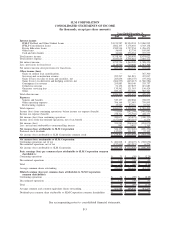

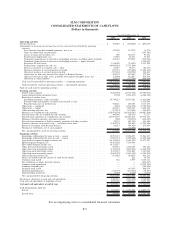

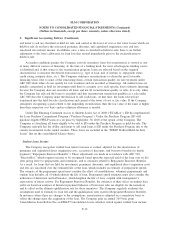

SLM CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except per share amounts)

2009 2008 2007

Years Ended December 31,

Interest income:

FFELP Stafford and Other Student Loans .............................. $1,211,587 $1,994,394 $ 2,060,993

FFELP Consolidation Loans . . . .................................... 1,882,195 3,178,692 4,343,138

Private Education Loans .......................................... 1,582,514 1,737,554 1,456,471

Other loans . . . . . .............................................. 56,005 82,734 105,843

Cash and investments . . .......................................... 26,064 276,264 707,577

Total interest income .............................................. 4,758,365 7,269,638 8,674,022

Total interest expense.............................................. 3,035,639 5,905,418 7,085,772

Net interest income . .............................................. 1,722,726 1,364,220 1,588,250

Less: provisions for loan losses . . . .................................... 1,118,960 719,650 1,015,308

Net interest income after provisions for loan losses. . . ....................... 603,766 644,570 572,942

Other income (loss):

Gains on student loan securitizations .................................. — — 367,300

Servicing and securitization revenue .................................. 295,297 261,819 437,097

Gains (losses) on sales of loans and securities, net . ....................... 283,836 (186,155) (95,492)

Gains (losses) on derivative and hedging activities, net . . . . . ................ (604,535) (445,413) (1,360,584)

Contingency fee revenue .......................................... 295,883 340,140 335,737

Collections revenue . . . .......................................... 51,152 127,823 219,683

Guarantor servicing fees .......................................... 135,562 121,363 156,429

Other ....................................................... 929,151 392,076 385,303

Total other income. . .............................................. 1,386,346 611,653 445,473

Expenses:

Salaries and benefits . . . .......................................... 549,137 602,868 728,095

Other operating expenses.......................................... 706,169 712,083 759,895

Restructuring expenses . .......................................... 13,767 83,516 22,505

Total expenses . . . . .............................................. 1,269,073 1,398,467 1,510,495

Income (loss) from continuing operations, before income tax expense (benefit) . . . .... 721,039 (142,244) (492,080)

Income tax expense (benefit) ......................................... 238,364 (76,769) 408,275

Net income (loss) from continuing operations ............................. 482,675 (65,475) (900,355)

Income (loss) from discontinued operations, net of tax benefit . . ................ (157,690) (143,219) 6,276

Net income (loss) . . .............................................. 324,985 (208,694) (894,079)

Less: net income attributable to noncontrolling interest ....................... 847 3,932 2,315

Net income (loss) attributable to SLM Corporation ....................... 324,138 (212,626) (896,394)

Preferred stock dividends . .......................................... 145,836 111,206 37,145

Net income (loss) attributable to SLM Corporation common stock ............... $ 178,302 $ (323,832) $ (933,539)

Net income (loss) attributable to SLM Corporation:

Continuing operations, net of tax . . .................................... $ 481,828 $ (69,407) $ (902,670)

Discontinued operations, net of tax .................................... (157,690) (143,219) 6,276

Net income (loss) attributable to SLM Corporation . . . ....................... $ 324,138 $ (212,626) $ (896,394)

Basic earnings (loss) per common share attributable to SLM Corporation common

shareholders:

Continuing operations . . . .......................................... $ .71 $ (.39) $ (2.28)

Discontinued operations . . .......................................... $ (.33) $ (.30) $ .02

Total . . ....................................................... $ .38 $ (.69) $ (2.26)

Average common shares outstanding ................................... 470,858 466,642 412,233

Diluted earnings (loss) per common share attributable to SLM Corporation

common shareholders:

Continuing operations . . . .......................................... $ .71 $ (.39) $ (2.28)

Discontinued operations . . .......................................... $ (.33) $ (.30) $ .02

Total . . ....................................................... $ .38 $ (.69) $ (2.26)

Average common and common equivalent shares outstanding . . . ................ 471,584 466,642 412,233

Dividends per common share attributable to SLM Corporation common shareholders . . $ — $ — $ .25

See accompanying notes to consolidated financial statements.

F-5