Sallie Mae 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

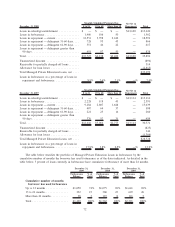

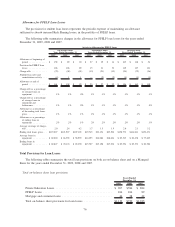

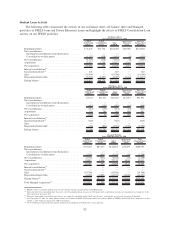

The following table includes on-balance sheet asset information for our Lending business segment.

2009 2008

December 31,

FFELP Stafford and Other Student Loans, net ....................... $ 42,979 $ 44,025

FFELP Stafford Loans Held-for-Sale .............................. 9,696 8,451

FFELP Consolidation Loans, net ................................. 68,379 71,744

Private Education Loans, net .................................... 22,753 20,582

Other loans, net.............................................. 420 729

Investments

(1)

............................................... 12,387 8,445

Retained Interest in off-balance sheet securitized loans . . ............... 1,828 2,200

Other

(2)

.................................................... 9,398 9,947

Total assets ................................................. $167,840 $166,123

(1)

Investments include cash and cash equivalents, short and long-term investments, restricted cash and investments, leveraged leases,

and municipal bonds.

(2)

Other assets include accrued interest receivable, goodwill and acquired intangible assets and other non-interest-earning assets.

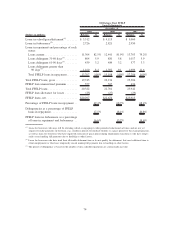

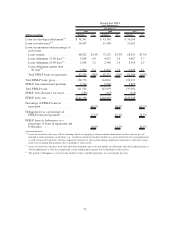

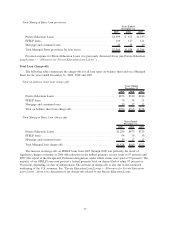

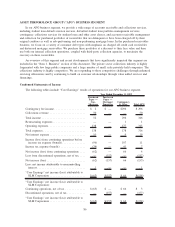

Loan Originations

The Company originates loans under its own brand names, which we refer to as internal lending brands,

and also through Lender Partners under forward contracts to purchase loans at contractual prices. In the past,

we referred to these combined channels as Preferred Channel Originations. As discussed at the beginning of

this “LENDING BUSINESS SEGMENT,” legislative changes and credit market conditions have resulted in

other FFELP lenders reducing their participation in the FFELP program.

As a result of the impacts described above, our FFELP internal brand originations were up sharply in

2009, increasing 40 percent from the prior year. Our FFELP lender partner originations declined 42 percent

from 2008 to 2009. A number of these Lender Partners, including some of our largest originators have

converted to third-party servicing arrangements in which we service loans on their behalf. Combined, total

FFELP loan originations increased 21 percent in 2009.

Total Private Education Loan originations declined 50 percent from the prior year to $3.2 billion in the

year ended December 31, 2009, as a result of a continued tightening of our underwriting criteria, an increase

in guaranteed student loan limits and the Company’s withdrawal from certain markets.

At December 31, 2009, the Company was committed to purchase $1.3 billion of loans originated by our

Lender Partners ($820 million of FFELP loans and $456 million of Private Education Loans). Approximately

$240 million of these FFELP loans were originated prior to CCRAA. Approximately $533 million of these

FFELP loans are eligible for ED’s Purchase and Participation Programs (see “LIQUIDITY AND CAPITAL

RESOURCES — ED Funding Programs”).

80