Sallie Mae 2009 Annual Report Download - page 213

Download and view the complete annual report

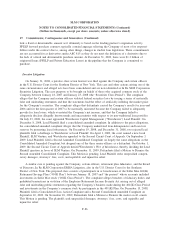

Please find page 213 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17. Commitments, Contingencies and Guarantees (Continued)

lack a fixed or determinable amount as it ultimately is based on the lending partner’s origination activity.

FFELP forward purchase contracts typically contain language relieving the Company of most of its responsi-

bilities under the contract due to, among other things, changes in student loan legislation. These commitments

are not accounted for as derivatives under ASC 815 as they do not meet the definition of a derivative due to

the lack of a fixed and determinable purchase amount. At December 31, 2009, there were $1.3 billion of

originated loans (FFELP and Private Education Loans) in the pipeline that the Company is committed to

purchase.

Investor Litigation

On January 31, 2008, a putative class action lawsuit was filed against the Company and certain officers

in the U.S. District Court for the Southern District of New York. This case and other actions arising out of the

same circumstances and alleged acts have been consolidated and are now identified as In Re SLM Corporation

Securities Litigation. The case purports to be brought on behalf of those who acquired common stock of the

Company between January 18, 2007 and January 23, 2008 (the “Securities Class Period”). The complaint

alleges that the Company and certain officers violated federal securities laws by issuing a series of materially

false and misleading statements and that the statements had the effect of artificially inflating the market price

for the Company’s securities. The complaint alleges that defendants caused the Company’s results for year-end

2006 and for the first quarter of 2007 to be materially misstated because the Company failed to adequately

provide for loan losses, which overstated the Company’s net income, and that the Company failed to

adequately disclose allegedly known trends and uncertainties with respect to its non-traditional loan portfolio.

On July 23, 2008, the court appointed Westchester Capital Management (“Westchester”) Lead Plaintiff. On

December 8, 2008, Lead Plaintiff filed a consolidated amended complaint. In addition to the prior allegations,

the consolidated amended complaint alleges that the Company understated loan delinquencies and loan loss

reserves by promoting loan forbearances. On December 19, 2008, and December 31, 2008, two rejected lead

plaintiffs filed a challenge to Westchester as Lead Plaintiff. On April 1, 2009, the court named a new Lead

Plaintiff, SLM Venture, and Westchester appealed to the Second Circuit Court of Appeals. On September 3,

2009, Lead Plaintiffs filed a Second Amended Consolidated Complaint on largely the same allegations as the

Consolidated Amended Complaint, but dropped one of the three senior officers as a defendant. On October 1,

2009, the Second Circuit Court of Appeals denied Westchester’s Writ of Mandamus, thereby deciding the Lead

Plaintiff question in favor of SLM Venture. On December 11, 2009, Defendants filed a Motion to Dismiss the

Second Amended Consolidated Complaint. This Motion is pending. Lead Plaintiff seeks unspecified compen-

satory damages, attorneys’ fees, costs, and equitable and injunctive relief.

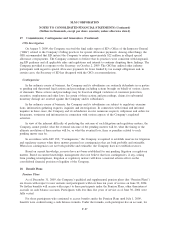

A similar case is pending against the Company, certain officers, retirement plan fiduciaries, and the Board

of Directors, In Re SLM Corporation ERISA Litigation, also in the U.S. District Court for the Southern

District of New York. The proposed class consists of participants in or beneficiaries of the Sallie Mae 401(K)

Retirement Savings Plan (“401K Plan”) between January 18, 2007 and “the present” whose accounts included

investments in Sallie Mae stock (“401K Class Period”). The complaint alleges breaches of fiduciary duties and

prohibited transactions in violation of the Employee Retirement Income Security Act arising out of alleged

false and misleading public statements regarding the Company’s business made during the 401(K) Class Period

and investments in the Company’s common stock by participants in the 401(K) Plan. On December 15, 2008,

Plaintiffs filed a Consolidated Class Action Complaint and a Second Consolidated Amended Complaint on

September 10, 2009. On November 10, 2009, Defendants filed a Motion to Dismiss the matter on all counts.

This Motion is pending. The plaintiffs seek unspecified damages, attorneys’ fees, costs, and equitable and

injunctive relief.

F-86

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)