Sallie Mae 2009 Annual Report Download - page 207

Download and view the complete annual report

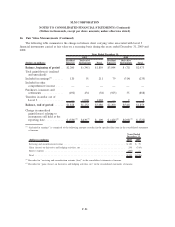

Please find page 207 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16. Fair Value Measurements

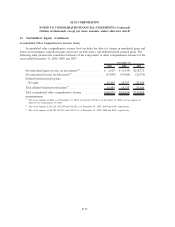

The Company uses estimates of fair value in applying various accounting standards for its financial

statements. Under GAAP, fair value measurements are used in one of four ways:

• In the consolidated balance sheet with changes in fair value recorded in the consolidated statement of

income;

• In the consolidated balance sheet with changes in fair value recorded in the accumulated other

comprehensive income section of the consolidated statement of changes in stockholders’ equity;

• In the consolidated balance sheet for instruments carried at lower of cost or fair value with impairment

charges recorded in the consolidated statement of income; and

• In the notes to the financial statements.

Fair value is defined as the price to sell an asset or transfer a liability in an orderly transaction between

willing and able market participants. In general, the Company’s policy in estimating fair values is to first look

at observable market prices for identical assets and liabilities in active markets, where available. When these

are not available, other inputs are used to model fair value such as prices of similar instruments, yield curves,

volatilities, prepayment speeds, default rates and credit spreads (including for the Company’s liabilities),

relying first on observable data from active markets. Additional adjustments may be made for factors including

liquidity, credit, bid/offer spreads, etc., depending on current market conditions. Transaction costs are not

included in the determination of fair value. When possible, the Company seeks to validate the model’s output

with market transactions. Depending on the availability of observable inputs and prices, different valuation

models could produce materially different fair value estimates. The values presented may not represent future

fair values and may not be realizable.

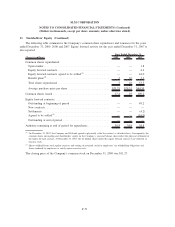

The Company categorizes its fair value estimates based on a hierarchical framework associated with three

levels of price transparency utilized in measuring financial instruments at fair value. Classification is based on

the lowest level of input that is significant to the fair value of the instrument. The three levels are as follows:

• Level 1 — Quoted prices (unadjusted) in active markets for identical assets or liabilities that the

reporting entity has the ability to access at the measurement date. The types of financial instruments

included in level 1 are highly liquid instruments with quoted prices.

• Level 2 — Inputs from active markets, other than quoted prices for identical instruments, are used to

determine fair value. Significant inputs are directly observable from active markets for substantially the

full term of the asset or liability being valued.

• Level 3 — Pricing inputs significant to the valuation are unobservable. Inputs are developed based on

the best information available; however, significant judgment is required by management in developing

the inputs.

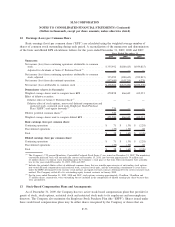

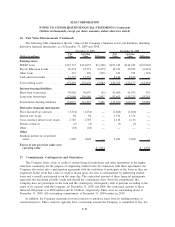

Student Loans

The Company’s FFELP loans and Private Education Loans are accounted for at cost or at the lower of

cost or market if the loan is held-for-sale; however, the fair value is disclosed in compliance with GAAP.

FFELP loans classified as held-for-sale are those which the Company has the ability and intent to sell under

various ED loan purchase programs. In these instances, the FFELP loans are valued using the committed sales

price under the programs. For all other FFELP loans and Private Education Loans, fair value was determined

by modeling loan cash flows using stated terms of the assets and internally-developed assumptions to

determine aggregate portfolio yield, net present value and average life. The significant assumptions used to

project cash flows are prepayment speeds, default rates, cost of funds, required return on equity, and expected

F-80

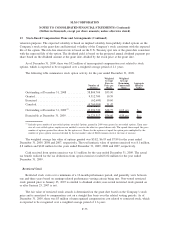

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)