Sallie Mae 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

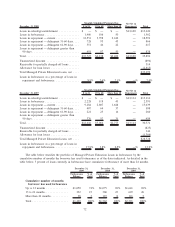

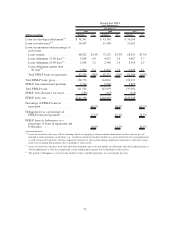

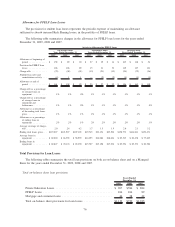

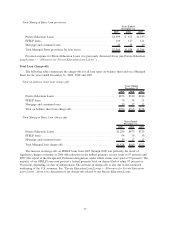

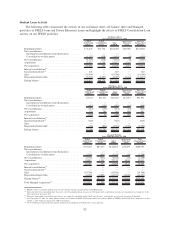

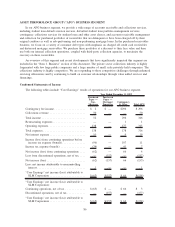

Student Loan Activity

The following tables summarize the activity in our on-balance sheet, off-balance sheet and Managed

portfolios of FFELP loans and Private Education Loans and highlight the effects of FFELP Consolidation Loan

activity on our FFELP portfolios.

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total On-

Balance Sheet

Portfolio

On-Balance Sheet

Years Ended December 31, 2009

Beginning balance . ........................... $52,476 $71,744 $124,220 $20,582 $144,802

Net consolidations:

Incremental consolidations from third parties . . ....... — — — — —

Consolidations to third parties . . ................. (1,113) (518) (1,631) (8) (1,639)

Net consolidations . ........................... (1,113) (518) (1,631) (8) (1,639)

Acquisitions ................................ 25,677 1,150 26,827 4,343 31,170

Net acquisitions . . ........................... 24,564 632 25,196 4,335 29,531

Internal consolidations

(2)

........................ — — — — —

Securitization-related

(3)

......................... 645 — 645 — 645

Sales..................................... (19,300) — (19,300) — (19,300)

Repayments/claims/other . . ...................... (5,710) (3,997) (9,707) (2,164) (11,871)

Ending balance . . . ........................... $52,675 $68,379 $121,054 $22,753 $143,807

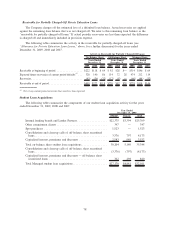

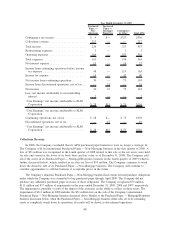

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total Off-

Balance Sheet

Portfolio

Off-Balance Sheet

Years Ended December 31, 2009

Beginning balance ............................. $7,143 $15,531 $22,674 $12,917 $35,591

Net consolidations:

Incremental consolidations from third parties .......... — — — — —

Consolidations to third parties ................... (413) (138) (551) (18) (569)

Net consolidations ............................. (413) (138) (551) (18) (569)

Acquisitions . . . .............................. 135 208 343 498 841

Net acquisitions .............................. (278) 70 (208) 480 272

Internal consolidations

(2)

......................... — — — — —

Securitization-related

(3)

......................... (645) — (645) — (645)

Sales . . ................................... — — — — —

Repayments/claims/other ........................ (720) (804) (1,524) (1,056) (2,580)

Ending balance . .............................. $5,500 $14,797 $20,297 $12,341 $32,638

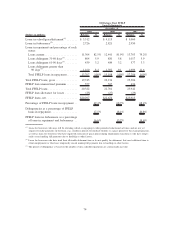

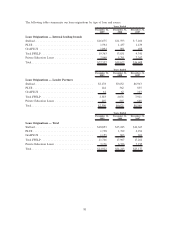

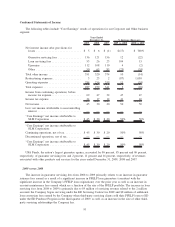

FFELP

Stafford and

Other

(1)

FFELP

Consolidation

Loans

Total

FFELP

Total Private

Education

Loans

Total

Managed Basis

Portfolio

Managed Portfolio

Years Ended December 31, 2009

Beginning balance ........................... $59,619 $87,275 $146,894 $33,499 $180,393

Net consolidations:

Incremental consolidations from third parties ........ — — — — —

Consolidations to third parties .................. (1,526) (656) (2,182) (26) (2,208)

Net consolidations ........................... (1,526) (656) (2,182) (26) (2,208)

Acquisitions . . . ............................ 25,812 1,358 27,170 4,841 32,011

Net acquisitions . ............................ 24,286 702 24,988 4,815 29,803

Internal consolidations

(2)

....................... — — — — —

Securitization-related

(3)

........................ — — — — —

Sales . . . ................................. (19,300) — (19,300) — (19,300)

Repayments/claims/other ....................... (6,430) (4,801) (11,231) (3,220) (14,451)

Ending balance

(4)

............................ $58,175 $83,176 $141,351 $35,094 $176,445

Total Managed Acquisitions

(5)

.................... $25,812 $ 1,358 $ 27,170 $ 4,841 $ 32,011

(1)

FFELP category is primarily Stafford Loans but also includes federally guaranteed PLUS and HEAL Loans.

(2)

Represents borrowers consolidating their loans into a new Consolidation Loan. Loans in our off-balance sheet securitization trusts that are consolidated are bought out of the

trusts and moved on-balance sheet.

(3)

Represents loans within securitization trusts that we are required to consolidate under GAAP once the trusts’ loan balances are below the clean-up call threshold.

(4)

As of December 31, 2009, the ending balance includes $15.9 billion of FFELP Stafford and Other Loans and $2.6 billion of FFELP Consolidation Loans disbursed on or after

October 1, 2007, which are impacted by CCRAA legislation.

(5)

The Total Managed Acquisitions line includes incremental consolidations from third parties and acquisitions.

82