Sallie Mae 2009 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

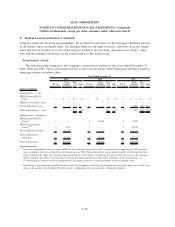

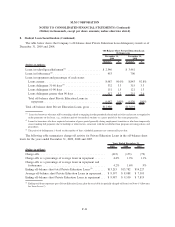

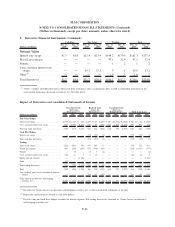

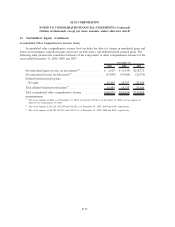

9. Derivative Financial Instruments (Continued)

(Dollars in billions)

Dec. 31,

2009

Dec. 31,

2008

Dec. 31,

2009

Dec. 31,

2008

Dec. 31,

2009

Dec. 31,

2008

Dec. 31,

2009

Dec. 31,

2008

Cash Flow Fair Value Trading Total

Notional Values

Interest rate swaps .......... $1.7 $4.8 $12.4 $13.4 $148.2 $159.3 $162.3 $177.5

Floor/Cap contracts .......... — — — — 47.1 32.4 47.1 32.4

Futures ................... — — — — .1 .2 .1 .2

Cross currency interest rate

swaps .................. — — 19.3 23.1 .3 .1 19.6 23.2

Other

(1)

................... — — — — 1.0 .7 1.0 .7

Total derivatives ............ $1.7 $4.8 $31.7 $36.5 $196.7 $192.7 $230.1 $234.0

(1)

“Other” includes embedded derivatives bifurcated from on-balance sheet securitization debt, as well as embedded derivatives in the

asset-backed financings discussed in footnote 2 to the table above.

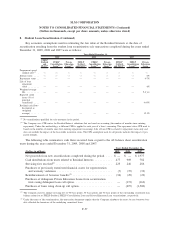

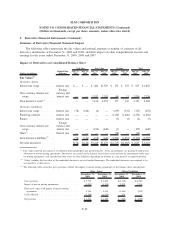

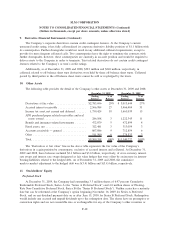

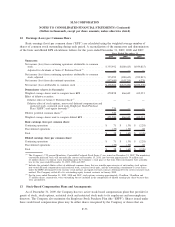

Impact of Derivatives on Consolidated Statements of Income

(Dollars in millions) 2009 2008 2007 2009 2008 2007 2009 2008 2007 2009 2008 2007

Realized Gain

(Loss) on

Derivatives

(3)

Unrealized Gain

(Loss) on

Derivatives

(1)(2)

Unrealized Gain

(Loss) on

Hedged Item

(1)

Total Gain (Loss)

Fair Value Hedges

Interest rate swaps . .................. $(801) $ 1,427 $ 458 $ 403 $ 157 $(155) $ 850 $(1,532) $ (468) $ 452 $ 52 $ (165)

Cross currency interest rate swaps . ......... 692 (1,537) 2,200 440 67 (139) (934) 1,864 (2,129) 198 394 (68)

Total fair value derivatives .............. (109) (110) 2,658 843 224 (294) (84) 332 (2,597) 650 446 (233)

Cash Flow Hedges

Interest rate swaps . .................. 2 — — (75) (37) (1) — — — (73) (37) (1)

Total cash flow derivatives .............. 2 — — (75) (37) (1) — — — (73) (37) (1)

Trading

Interest rate swaps . .................. (526) (261) 360 433 584 51 — — — (93) 323 411

Floor/Cap contracts .................. 483 (529) (209) (717) (488) (68) — — — (234) (1,017) (277)

Futures . . . ....................... 1 (3) — (1) 3 (1) — — — — — (1)

Cross currency interest rate swaps . ......... (26) 11 3 4 16 — — — — (22) 27 3

Equity forward contracts . .............. — — (1,558) — — — — — — — — (1,558)

Other ........................... (65) — — 1 — — — — — (64) — —

Total trading derivatives . . .............. (133) (782) (1,404) (280) 115 (18) — — — (413) (667) (1,422)

Total ........................... (240) (892) 1,254 488 302 (313) (84) 332 (2,597) 164 (258) (1,656)

Less: realized gains (losses) recorded in interest

expense . ....................... — — — 768 187 (295) — — — 768 187 (295)

Gains (losses) on derivative and hedging

activities, net . . . .................. $(240) $ (892) $ 1,254 $(280) $ 115 $ (18) $ (84) $ 332 $(2,597) $(604) $ (445) $(1,361)

(1)

Recorded in “Gains (losses) on derivative and hedging activities, net” in the consolidated statements of income.

(2)

Represents ineffectiveness related to cash flow hedges.

(3)

For fair value and cash flow hedges, recorded in interest expense. For trading derivatives, recorded in “Gains (losses) on derivative

and hedging activities, net.”

F-66

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)