Sallie Mae 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

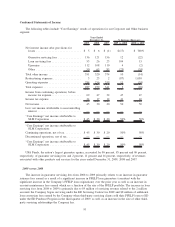

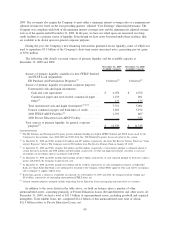

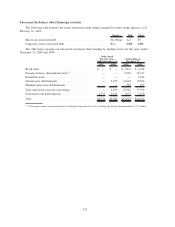

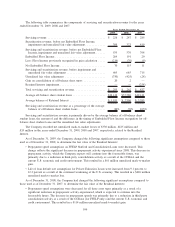

Managed Borrowings

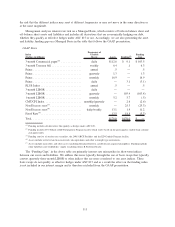

The following tables present the ending balances of our Managed borrowings at December 31, 2009,

2008 and 2007, and average balances and average interest rates of our Managed borrowings for the years

ended December 31, 2009, 2008 and 2007. The average interest rates include derivatives that are economically

hedging the underlying debt but do not qualify for hedge accounting treatment under ASC 815. (See

“BUSINESS SEGMENTS — Limitations of ‘Core Earnings’ — Pre-tax Differences between ‘Core Earnings’

and GAAP by Business Segment — Derivative Accounting — Reclassification of Realized Gains (Losses) on

Derivative and Hedging Activities.”)

Ending Balances

Short

Term

Long

Term

Total

Managed

Basis

Short

Term

Long

Term

Total

Managed

Basis

Short

Term

Long

Term

Total

Managed

Basis

Ending Balance Ending Balance Ending Balance

2009 2008 2007

As of December 31,

Unsecured borrowings . . . ........... $ 5,185 $ 22,797 $ 27,982 $ 6,794 $ 31,182 $ 37,976 $ 8,297 $ 36,796 $ 45,093

Unsecured term bank deposits . . . ...... 842 4,795 5,637 1,148 1,108 2,256 254 — 254

Indentured trusts (on-balance sheet) ..... 64 1,533 1,597 31 1,972 2,003 100 2,481 2,581

ED Participation Program facility (on-

balance sheet)

(1)

................. 9,006 — 9,006 7,365 — 7,365 — — —

ED Conduit Program facility (on-balance

sheet) . . ..................... 14,314 — 14,314 — — — — — —

ABCP borrowings (on-balance sheet)

(2)

. . . — 8,801 8,801 24,768 — 24,768 25,960 67 26,027

Securitizations (on-balance sheet) . ...... — 89,200 89,200 — 80,601 80,601 — 68,048 68,048

Securitizations (off-balance sheet). ...... — 33,615 33,615 — 37,159 37,159 — 42,088 42,088

Other ......................... 1,472 — 1,472 1,827 — 1,827 1,342 — 1,342

Total.......................... $30,883 $160,741 $191,624 $41,933 $152,022 $193,955 $35,953 $149,480 $185,433

(1)

The Company has the option of paying off this amount with cash or by putting the loans to ED as previously discussed.

(2)

Includes $1.9 billion outstanding in the 2008 Asset-Backed Loan Facility at December 31, 2008. There was no outstanding balance at

December 31, 2009 or December 31, 2007.

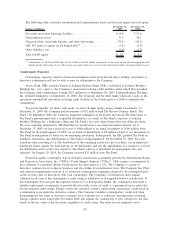

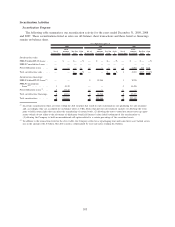

Average Balances

Average

Balance

Average

Rate

Average

Balance

Average

Rate

Average

Balance

Average

Rate

2009 2008 2007

Years Ended December 31,

Unsecured borrowings ............... $ 31,863 1.93% $ 39,794 3.65% $ 46,095 5.58%

Unsecured term bank deposits ......... 4,754 3.50 854 4.07 166 5.26

Indentured trusts (on-balance sheet) ..... 1,811 1.07 2,363 3.90 2,768 4.90

ED Participation Program facility (on-

balance sheet) ................... 14,174 1.43 1,727 3.43 — —

ED Conduit Program facility (on-balance

sheet) .......................... 7,340 .75 — — — —

ABCP borrowings (on-balance sheet)

(1)

. . . 16,239 2.93 24,855 5.27 13,938 5.85

Securitizations (on-balance sheet) ....... 85,612 1.38 76,028 3.26 62,765 5.55

Securitizations (off-balance sheet)....... 35,377 .82 39,625 3.11 45,733 5.68

Other ............................ 1,391 .31 2,063 2.35 637 4.85

Total ............................ $198,561 1.51% $187,309 3.58% $172,102 5.60%

(1)

Includes the 2008 Asset-Backed Loan Facility.

101