Sallie Mae 2009 Annual Report Download - page 209

Download and view the complete annual report

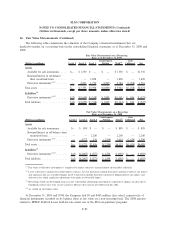

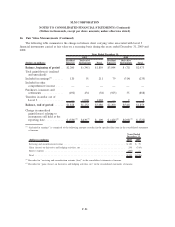

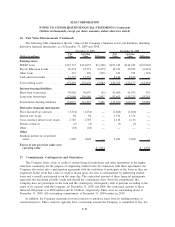

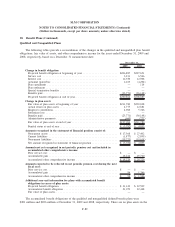

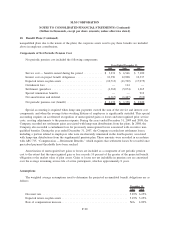

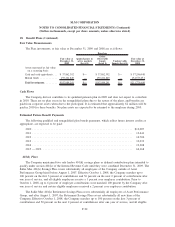

Please find page 209 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16. Fair Value Measurements (Continued)

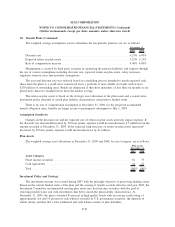

markets require significant adjustments and judgment in determining fair value that cannot be corroborated

with market transactions. When determining the fair value of derivatives, the Company takes into account

counterparty credit risk for positions where it is exposed to the counterparty on a net basis by assessing

exposure net of collateral held. The net exposures for each counterparty are adjusted based on market

information available for the specific counterparty, including spreads from credit default swaps. Additionally,

when the counterparty has exposure to the Company related to SLM Corporation derivatives, the Company

fully collateralizes the exposure, minimizing the adjustment necessary to the derivative valuations for the

Company’s credit risk. While trusts that contain derivatives are not required to post collateral to counterparties,

the credit quality and securitized nature of the trusts minimizes any adjustments for the counterparty’s

exposure to the trusts. It is the Company’s policy to compare its derivative fair values to those received by its

counterparties in order to validate the model’s outputs. The carrying value of borrowings designated as the

hedged item in an ASC 815 fair value hedge are adjusted for changes in fair value due to benchmark interest

rates and foreign-currency exchange rates. These valuations are determined through standard bond pricing

models and option models (when applicable) using the stated terms of the borrowings, and observable yield

curves, foreign currency exchange rates, and volatilities.

During 2008 and 2009, the bid/ask spread widened significantly for derivatives indexed to certain interest

rate indices as a result of market inactivity. As such, significant adjustments for the bid/ask spread and

unobservable inputs were used in the fair value calculation resulting in these instruments being classified as

level 3 in the fair value hierarchy. Additionally, significant unobservable inputs were used to model the

amortizing notional of some swaps tied to securitized asset balances and, as such, these derivatives have been

classified as level 3 in the fair value hierarchy. These swaps were transferred into level 3 during the first

quarter of 2009 due to a change in the assumption regarding successful remarketing and significant

unobservable inputs used to model notional amortizations.

Residual Interests

The Residual Interests are carried at fair value in the financial statements. No active market exists for

student loan Residual Interests; as such, the fair value is calculated using discounted cash flow models and

option models. Observable inputs from active markets are used where available, including yield curves and

volatilities. Significant unobservable inputs such as prepayment speeds, default rates, certain bonds’ costs of

funds and discount rates are used in determining the fair value and require significant judgment. These

unobservable inputs are internally determined based upon analysis of historical data and expected industry

trends. On a quarterly basis the Company back tests its prepayment speed, default rates and costs of funds

assumptions by comparing those assumptions to actuals experienced. Additionally, the Company uses non-

binding broker quotes and industry analyst reports which show changes in the indicative prices of the asset-

backed securities tranches immediately senior to the Residual Interest as an indication of potential changes in

the discount rate used to value the Residual Interests. Market transactions are not available to validate the

models’ results. An analysis of the impact of changes to significant inputs is addressed further in Note 8,

“Student Loan Securitization.”

F-82

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)