Sallie Mae 2009 Annual Report Download - page 227

Download and view the complete annual report

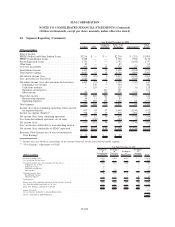

Please find page 227 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20. Segment Reporting (Continued)

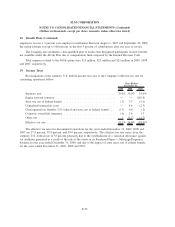

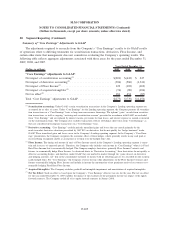

$79 million, $111 million and $17 million of impairments in the years ended December 31, 2009, 2008 and

2007, respectively. The impairment is primarily a result of the impact of the economy on the ability to collect on

these assets. The impairment of $111 million in 2008 includes the $51 million loss on the sale of the Company’s

international Purchased Paper — Non-Mortgage business discussed above. Similar to the Purchased Paper —

Mortgage/Properties business discussion below, when the Purchased Paper — Non-Mortgage business either sells

all of its remaining assets or completely winds down its operations, its results will be shown as discontinued

operations.

Net loss attributable to SLM Corporation from discontinued operations was $157 million and $140 million

for the years ended December 31, 2009 and 2008, respectively, compared to net income of $15 million for the

year ended December 31, 2007. The Company sold all of the assets in its Purchased Paper — Mortgage/

Properties business in the fourth quarter of 2009 for $280 million. Because of the sale, the Purchased Paper —

Mortgage/Properties business is required to be presented separately as discontinued operations for all periods

presented. This sale of assets in the fourth quarter of 2009 resulted in an after-tax loss of $95 million. Total

after-tax impairments, including the loss on sale, for the years ended December 31, 2009, 2008 and 2007 were

$154 million, $161 million and $2 million, respectively.

At December 31, 2009 and 2008, the APG business segment had total assets of $1.1 billion and

$2.0 billion, respectively.

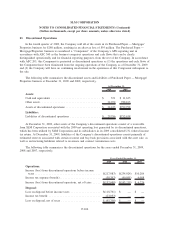

Corporate and Other

The Company’s Corporate and Other segment includes the aggregate activity of its smaller operating

segments, primarily its Guarantor Servicing, Loan Servicing and Upromise operating segments. Corporate and

Other also includes several smaller products and services, as well as corporate overhead.

In the Guarantor Servicing operating segment, the Company provides a full complement of administrative

services to FFELP Guarantors including guarantee issuance, account maintenance, and guarantee fulfillment.

In the Loan Servicing operating segment, the Company provides a full complement of activities required to

service student loans on behalf of lenders who are unrelated to the Company. Such servicing activities

generally commence once a loan has been fully disbursed and include sending out payment coupons to

borrowers, processing borrower payments, originating and disbursing FFELP Consolidation Loans on behalf of

the lender, and other administrative activities required by ED.

Upromise markets and administers a consumer savings network and also provides program management,

transfer and servicing agent services, and administration services for 529 college-savings plans. The

Company’s other products and services include comprehensive financing and loan delivery solutions that it

provides to college financial aid offices and students to streamline the financial aid process. Corporate

overhead includes all of the typical headquarter functions such as executive management, accounting and

finance, human resources and marketing.

At December 31, 2009 and 2008, the Corporate and Other business segment had total assets of

$1.2 million and $685 million, respectively.

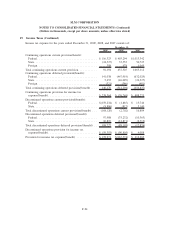

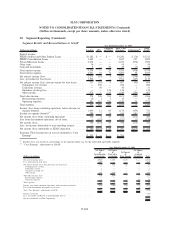

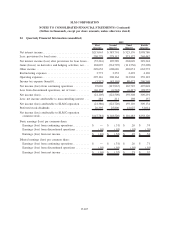

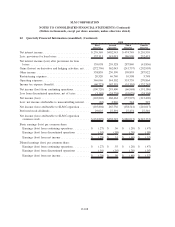

Measure of Profitability

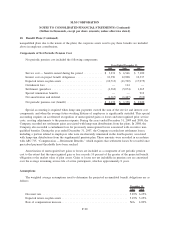

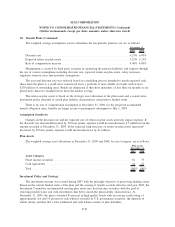

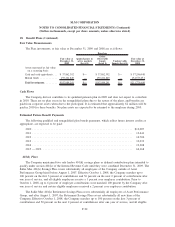

The tables below include the condensed operating results for each of the Company’s reportable segments.

Management, including the chief operating decision makers, evaluates the Company on certain performance

measures that the Company refers to as “Core Earnings” performance measures for each operating segment.

While “Core Earnings” results are not a substitute for reported results under GAAP, the Company relies on

F-100

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)