Sallie Mae 2009 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

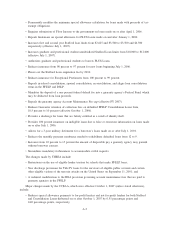

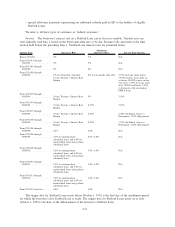

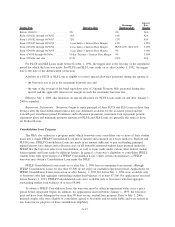

Trigger Date Borrower Rate

Maximum

Borrower Rate

Interest

Rate

Margin

Before10/01/81.................... 9% 9% N/A

From 10/01/81 through 10/30/82 . . . . . . . . 14% 14% N/A

From 11/01/82 through 06/30/87 . . . . . . . . 12% 12% N/A

From 07/01/87 through 09/30/92 . . . . . . . . 1-year Index + Interest Rate Margin 12% 3.25%

From 10/01/92 through 06/30/94 . . . . . . . . 1-year Index + Interest Rate Margin PLUS 10%, SLS 11% 3.10%

From 07/01/94 through 06/30/98 . . . . . . . . 1-year Index + Interest Rate Margin 9% 3.10%

From 6/30/98 through 06/30/06 . . . . . . . . . 91-day Treasury + Interest Rate Margin 9% 3.10%

From 07/01/06 and after . . . . . . . . . . . . . . 8.5% 8.5% N/A

For PLUS and SLS Loans made before October 1, 1992, the trigger date is the first day of the enrollment

period for which the loan was made. For PLUS and SLS Loans made on or after October 1, 1992, the trigger

date is the date of the disbursement of the loan.

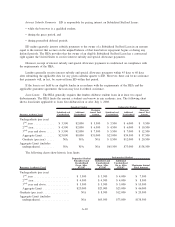

A holder of a PLUS or SLS Loan is eligible to receive special allowance payments during any quarter if:

• the borrower rate is set at the maximum borrower rate and

• the sum of the average of the bond equivalent rates of 3-month Treasury bills auctioned during that

quarter and the applicable interest rate margin exceeds the maximum borrower rate.

Effective July 1, 2006, this limitation on special allowance for PLUS Loans made on and after January 1,

2000 is repealed.

Repayment, Deferments. Borrowers begin to repay principal of their PLUS and SLS Loans no later than

60 days after the final disbursement unless they use deferment available for the in-school period and the

6-month post enrollment period. Deferment and forbearance provisions, maximum loan repayment periods,

repayment plans and minimum payment amounts for PLUS and SLS Loans are generally the same as those

for Stafford Loans.

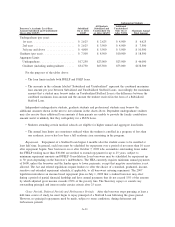

Consolidation Loan Program

The HEA also authorizes a program under which borrowers may consolidate one or more of their student

loans into a single FFELP Consolidation Loan that is insured and reinsured on a basis similar to Stafford and

PLUS Loans. FFELP Consolidation Loans are made in an amount sufficient to pay outstanding principal,

unpaid interest, late charges and collection costs on all federally reinsured student loans incurred under the

FFELP that the borrower selects for consolidation, as well as loans made under various other federal student

loan programs and loans made by different lenders. In general, a borrower’s eligibility to consolidate FFELP

student loans ends upon receipt of a FFELP Consolidation Loan. Under certain circumstances, a FFELP

borrower may obtain a Consolidation Loan under the DSLP.

FFELP Consolidation Loans made on or after July 1, 1994 have no minimum loan amount, although

FFELP Consolidation Loans for less than $7,500 do not enjoy an extended repayment period. Applications for

FFELP Consolidation Loans received on or after January 1, 1993 but before July 1, 1994 were available only

to borrowers who had aggregate outstanding student loan balances of at least $7,500. For applications received

before January 1, 1993, FFELP Consolidation Loans were available only to borrowers who had aggregate

outstanding student loan balances of at least $5,000.

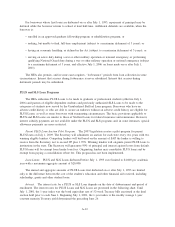

To obtain a FFELP Consolidation Loan, the borrower must be either in repayment status or in a grace

period before repayment begins. In addition, for applications received before January 1, 1993, the borrower

must not have been delinquent by more than 90 days on any student loan payment. Prior to July 1, 2006,

married couples who were eligible to consolidate agreed to be jointly and severally liable and were treated as

one borrower for purposes of loan consolidation eligibility.

A-13