Sallie Mae 2009 Annual Report Download - page 181

Download and view the complete annual report

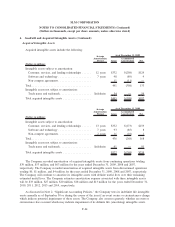

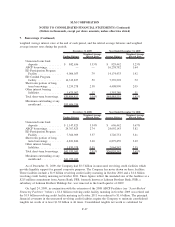

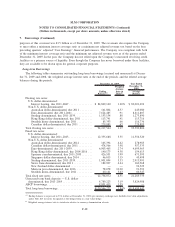

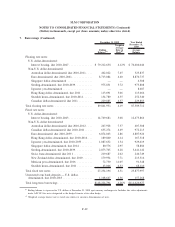

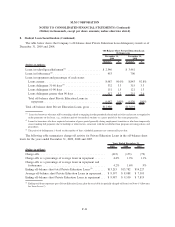

Please find page 181 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Borrowings (Continued)

On January 6, 2009, the Company closed a $1.5 billion 12.5 year asset-backed securities (“ABS”) based

facility. This facility is used to provide up to $1.5 billion term financing for Private Education Loans. The

fully-utilized cost of financing obtained under this facility is expected to be LIBOR plus 5.75 percent. In

connection with this facility, the Company completed one Private Education Loan term ABS transaction

totaling $1.5 billion in the first quarter of 2009. The net funding received under the asset-backed securities

based facility for this issuance was $1.1 billion.

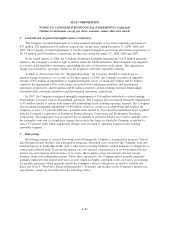

On February 6, 2009, the Federal Reserve Bank of New York published proposed terms for a program

designed to facilitate renewed issuance of consumer and small business ABS at lower interest rate spreads.

TALF was initiated on March 17, 2009 and currently provides investors who purchase eligible ABS with

funding of up to five years. Eligible ABS include ‘AAA’ rated student loan ABS backed by FFELP and

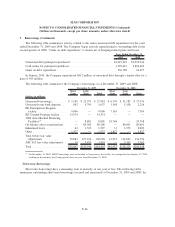

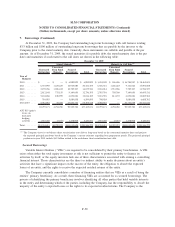

Private Education Loans first disbursed since May 1, 2007. The following $6.0 Billion of Private Education

Loan securitizations were completed in 2009 and were TALF eligible:

• On May 5, 2009, the Company priced a $2.6 billion Private Education Loan securitization which closed

on May 12, 2009. The issue bears a coupon of 1-month LIBOR plus 6.0 percent and is callable at the

issuer’s option at 93 percent of the outstanding balance of the ABS between November 15, 2011 and

April 16, 2012. If the issue is called on November 15, 2011, the Company expects the effective cost of

the financing will be approximately 1-month LIBOR plus 3.7 percent.

• On July 2, 2009, the Company priced a $1.1 billion Private Education Loan securitization which closed

on July 14, 2009. The issue bears a coupon of Prime plus 1.25 percent and is callable at the issuer’s

option at 94 percent of the outstanding balance of the ABS between January 16, 2012 and June 15,

2012. If the issue is called on January 16, 2012, the Company expects the effective cost of the

financing will be approximately Prime minus 0.71 percent.

• On August 5, 2009, the Company priced a $1.7 billion Private Education Loan securitization which

closed on August 13, 2009. The issue bears a coupon of Prime plus 0.25 percent and is callable at the

issuer’s option at 94 percent of the outstanding balance of the ABS between August 15, 2013 and

July 15, 2014. If the issue is called on August 15, 2013, the Company expects the effective cost of the

financing will be approximately Prime minus 0.55 percent.

• On December 2, 2009, the Company priced a $590 million Private Education Career Training Loan

securitization which closed on December 10, 2009. The issue includes one tranche that bears a coupon

of Prime minus 0.90 percent and a second tranche that bears a coupon of 1-month LIBOR plus

1.85 percent.

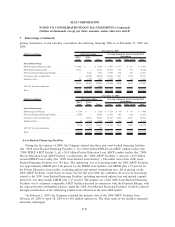

In certain of the Company’s securitizations, there are terms within the deal structure that result in such

securitization not qualifying for sale treatment and, as a result, is accounted for as a secured borrowing. Terms

that prevent sale treatment include: (1) allowing the Company to hold certain rights that can affect the

remarketing of certain bonds, (2) allowing the trust to enter into interest rate cap agreements after the initial

settlement of the securitization which do not relate to the reissuance of third-party beneficial interests or

(3) allowing the Company to hold an unconditional call option related to a certain percentage of the

securitized assets. These securitizations completed in 2009 are accounted for as secured borrowings.

The Company has concluded, for the Private Education Loan securitizations above which contain the

ability to call the bonds in the future at a discount to par, that it is probable it will call these bonds at the call

date at the respective discount. Probability is based on the Company’s assessment of whether these bonds can

be refinanced at the call date at or lower than a breakeven cost of funds based on the call discount. As a

result, the Company is accreting this call discount as a reduction to interest expense through the call date. If it

F-54

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)