Sallie Mae 2009 Annual Report Download - page 143

Download and view the complete annual report

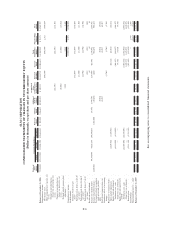

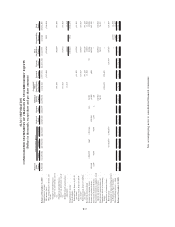

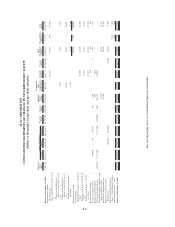

Please find page 143 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

management reviews the adequacy of the allowance for loan losses and determines if qualitative adjustments

need to be considered.

Previously, when Private Education Loans in the Company’s off-balance sheet securitized trusts settling

before September 30, 2005 become 180 days delinquent, the Company exercised its contingent call option

(the Company does not hold the contingent call option for any trusts settling after September 30, 2005) to

repurchase these loans at par value and record a loss for the difference in the par value paid and the fair

market value of the loan at the time of purchase, in accordance with ASC 310. Beginning in October 2008,

the Company decided to no longer exercise its contingent call option. The losses recorded upon repurchase of

loans under the contingent call option, for the years ended December 31, 2009, 2008, and 2007 were $0,

$141 million, and $123 million, respectively, and were recorded in the “Gains (losses) on sales of loans and

securities, net” line item in the consolidated statements of income. Subsequent to buyback, the Company

accounts for these loans under ASC 310 in the same manner as discussed under “Collections Revenue” for

the Company’s purchased paper portfolio. The initial valuation at buyback uses a discount rate similar to that

used in valuing the Private Education Loan Residual Interests as that rate takes into account the credit and

liquidity risks inherent in the loans being repurchased. Interest income recognized is recorded as part of

student loan interest income.

Cash and Cash Equivalents

Cash and cash equivalents includes term federal funds, Eurodollar deposits, money market funds and

bank deposits with original terms to maturity of less than three months.

Restricted Cash and Investments

Restricted cash primarily includes amounts for on-balance sheet student loan securitizations and other

secured borrowings. This cash must be used to make payments related to trust obligations. Amounts on

deposit in these accounts are primarily the result of timing differences between when principal and interest is

collected on the trust assets and when principal and interest is paid on trust liabilities.

In connection with the Company’s tuition payment plan product, the Company receives cash from

students and parents that in turn is owed to schools. This cash, a majority of which has been deposited at

Sallie Mae Bank, is held in escrow for the beneficial owners. In addition, the cash rebates that Upromise

members earn from qualifying purchases from Upromise’s participating companies are held in trust for the

benefit of the members. This cash is held pursuant to a trust document until distributed in accordance with the

Upromise member’s request and the terms of the Upromise service. Upromise, which acts as the trustee for

the trust, has deposited a majority of the cash with Sallie Mae Bank pursuant to a money market deposit

account agreement between Sallie Mae Bank and Upromise as trustee of the trust. Subject to capital

requirements and other laws, regulations and restrictions applicable to Utah industrial banks, the cash that is

deposited with Sallie Mae Bank in connection with the tuition payment plan and the Upromise rebates

described above is not restricted and, accordingly, is not included in restricted cash and investments in the

Company’s consolidated financial statements, as there is no restriction surrounding the use of funds by the

Company.

Securities pledged as collateral related to the Company’s derivative portfolio where the counterparty has rights

of rehypothecation, are classified as restricted. When the counterparty does not have these rights, the security is

recorded in investments and disclosed as pledged collateral in the notes. Additionally, certain counterparties require

cash collateral pledged to the Company to be segregated andheldinrestrictedcashaccountsperthetermsoftheir

International Swaps and Derivatives Association, Inc. (“ISDA”) Credit Support Annexes (“CSAs”). Cash balances

that the Company’s indentured trusts deposit in guaranteed investment contracts that are held in trust for the related

F-16

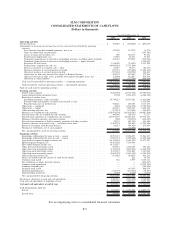

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)