Sallie Mae 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

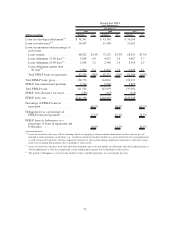

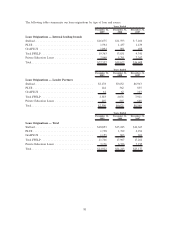

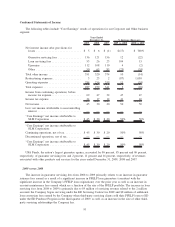

Other Income — Lending Business Segment

The following table summarizes the components of other income, net, for our Lending business segment

for the years ended December 31, 2009, 2008 and 2007.

2009 2008 2007

Years Ended

December 31,

Gains on debt repurchases ...................................... $536 $ 64 $ —

Gains (losses) on sales of loans and securities, net .................... 284 (51) 24

Late fees and forbearance fees ................................... 146 143 134

Gains on sales of mortgages and other loan fees...................... — 3 11

Other ..................................................... 8 21 25

Total other income, net ........................................ $974 $180 $194

The change in other income over the prior periods presented is primarily the result of the gains on debt

repurchased and gains on sales of loans. The Company began repurchasing its outstanding debt in the second

quarter of 2008. The Company repurchased $3.4 billion and $1.9 billion face amount of its senior unsecured

notes during the years ended December 31, 2009 and 2008, respectively. Since the second quarter of 2008, the

Company repurchased $5.3 billion face amount of its senior unsecured notes in the aggregate, with maturity

dates ranging from 2008 to 2016. The $284 million of gains on sales of loans and securities, net, in the year

ended December 31, 2009 related to the sale of approximately $18.5 billion face amount of FFELP loans to

the ED as part of the Purchase Program. The loss in 2008 primarily relates to the sale of approximately

$1.0 billion FFELP loans to ED under ECASLA, which resulted in a $53 million loss.

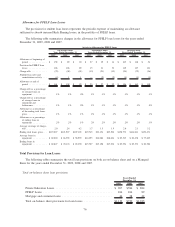

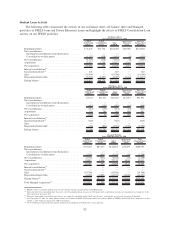

Operating Expenses — Lending Business Segment

The following table summarizes the components of operating expenses for our Lending business segment

for the years ended December 31, 2009, 2008 and 2007.

2009 2008 2007

Years Ended

December 31,

Sales and originations ......................................... $212 $235 $351

Servicing .................................................. 266 237 227

Corporate overhead ........................................... 103 111 112

Total operating expenses ....................................... $581 $583 $690

Operating expenses for our Lending business segment include costs incurred to service our Managed

student loan portfolio and acquire student loans, as well as other general and administrative expenses.

2009 versus 2008

Operating expenses for the year ended December 31, 2009, remained relatively unchanged from the prior

year. In 2009, operating expenses were higher as a result of higher collection costs from a higher number of

loans in repayment and delinquent status and higher direct-to-consumer marketing costs related to Private

Education Loans. These increases in operating expenses were offset primarily by the full-year effect of the

Company’s cost reduction efforts conducted throughout 2008.

2008 versus 2007

Operating expenses for the year ended December 31, 2008, decreased by 16 percent from 2007. The

decrease is primarily due to the impact of our cost reduction efforts and to the suspension of certain student

loan programs.

85