Sallie Mae 2009 Annual Report Download - page 158

Download and view the complete annual report

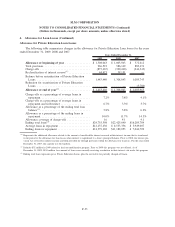

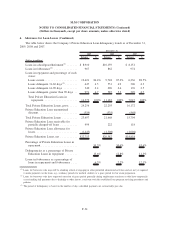

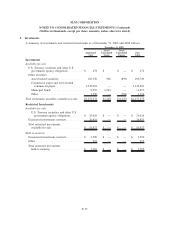

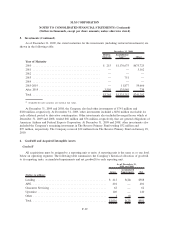

Please find page 158 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Student Loans (Continued)

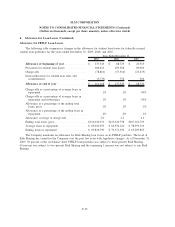

effectively when applied based on a borrower’s unique situation, including historical information and

judgments. The Company combines borrower information with a risk-based segmentation model to assist in its

decision making as to who will be granted forbearance based on the Company’s expectations as to a

borrower’s ability and willingness to repay their obligation. This strategy is aimed at mitigating the overall

risk of the portfolio as well as encouraging cash resolution of delinquent loans.

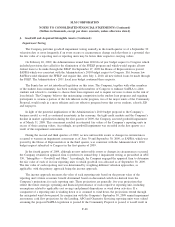

Forbearance may be granted to borrowers who are exiting their grace period to provide additional time to

obtain employment and income to support their obligations, or to current borrowers who are faced with a

hardship and request forbearance time to provide temporary payment relief. In these circumstances, a borrower’s

loan is placed into a forbearance status in limited monthly increments and is reflected in the forbearance status

at month-end during this time. At the end of their granted forbearance period, the borrower will enter repayment

status as current and is expected to begin making their scheduled monthly payments on a go-forward basis.

Forbearance may also be granted to borrowers who are delinquent in their payments. In these circum-

stances, the forbearance cures the delinquency and the borrower is returned to a current repayment status. In

more limited instances, delinquent borrowers will also be granted additional forbearance time. As the Company

has obtained further experience about the effectiveness of forbearance, the Company has reduced the amount of

time a loan will spend in forbearance, thereby increasing the Company’s ongoing contact with the borrower to

encourage consistent repayment behavior once the loan is returned to a current repayment status.

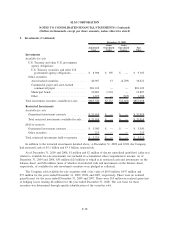

During the second quarter of 2009, the Company instituted an interest rate reduction program to assist

customers in repaying their Private Education Loans through reduced payments, while continuing to reduce

their outstanding principal balance. This program is offered in situations where the potential for principal

recovery, through a modification of the monthly payment amount, is better than other alternatives currently

available. Along with the ability and willingness to pay, the customer must make three consecutive monthly

payments at the reduced rate in order to qualify for the program. Once the customer has made the initial three

payments, the loans status is returned to current and the interest rate is reduced for the successive twelve

month period. At December 31, 2009, approximately $181 million face amount had qualified for the program

and are currently receiving a reduction in their interest rate.

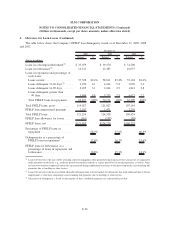

The Company may charge the borrower fees on certain Private Education Loans, either at origination,

when the loan enters repayment, or both. Such fees are deferred and recognized into income as a component

of interest over the estimated average life of the related pool of loans.

As of December 31, 2009 and 2008, 59 percent and 56 percent, respectively, of the Company’s

on-balance sheet student loan portfolio was in repayment.

F-31

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)