Sallie Mae 2009 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

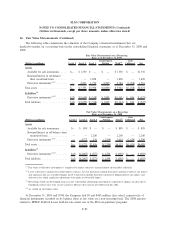

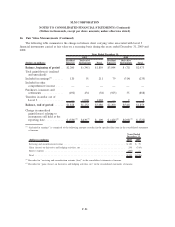

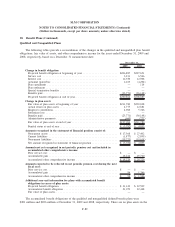

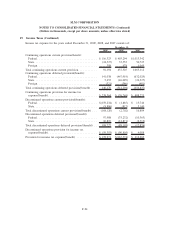

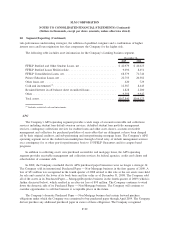

18. Benefit Plans (Continued)

Qualified and Nonqualified Plans

The following tables provide a reconciliation of the changes in the qualified and nonqualified plan benefit

obligations, fair value of assets, and other comprehensive income for the years ended December 31, 2009 and

2008, respectively, based on a December 31 measurement date:

2009 2008

December 31,

Change in benefit obligation

Projected benefit obligation at beginning of year . . ..................... $206,887 $227,651

Service cost . ................................................ 3,231 6,566

Interest cost . ................................................ 12,350 12,908

Actuarial (gain)/loss . .......................................... 2,169 (4,204)

Plan curtailment .............................................. — 114

Plan settlement ............................................... — —

Special termination benefits . ..................................... — —

Benefits paid . ................................................ (23,771) (36,148)

Projected benefit obligation at end of year. . .......................... $200,866 $206,887

Change in plan assets

Fair value of plan assets at beginning of year ......................... $211,780 $230,698

Actual return on plan assets . ..................................... 4,775 12,681

Employer contribution .......................................... 4,960 5,326

Settlement loss ............................................... — —

Benefits paid . ................................................ (23,771) (36,148)

Administrative payments . . . ..................................... (660) (777)

Fair value of plan assets at end of year .............................. $197,084 $211,780

Funded status at end of year. ..................................... $ (3,782) $ 4,893

Amounts recognized in the statement of financial position consist of:

Noncurrent assets . . . .......................................... $ 17,368 $ 27,402

Current liabilities . . . .......................................... (1,877) (2,895)

Noncurrent liabilities . .......................................... (19,273) (19,614)

Net amount recognized in statement of financial position . . ............... $ (3,782) $ 4,893

Amounts not yet recognized in net periodic pension cost and included in

accumulated other comprehensive income:

Prior service cost.............................................. $ — $ —

Accumulated gain . . . .......................................... 18,224 29,720

Accumulated other comprehensive income . .......................... $ 18,224 $ 29,720

Amounts expected to be reflected in net periodic pension cost during the next

fiscal year:

Prior service cost.............................................. $ — $ —

Accumulated gain . . . .......................................... 96 1,366

Accumulated other comprehensive income . .......................... $ 96 $ 1,366

Additional year-end information for plans with accumulated benefit

obligations in excess of plan assets:

Projected benefit obligation . ..................................... $ 21,149 $ 22,509

Accumulated benefit obligation . . . ................................ 21,079 22,448

Fair value of plan assets......................................... — —

The accumulated benefit obligations of the qualified and nonqualified defined benefit plans were

$201 million and $206 million at December 31, 2009 and 2008, respectively. There are no plan assets in the

F-89

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)