Sallie Mae 2009 Annual Report Download - page 167

Download and view the complete annual report

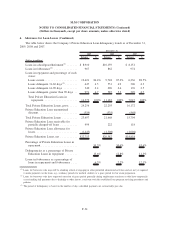

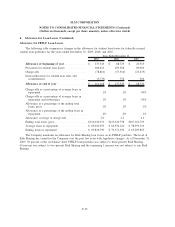

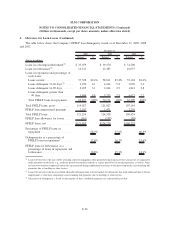

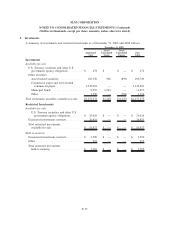

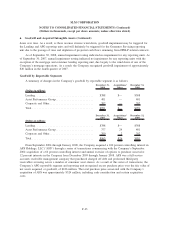

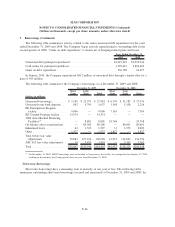

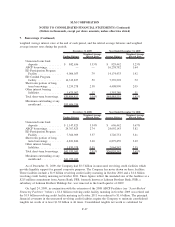

Please find page 167 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6. Goodwill and Acquired Intangible Assets (Continued)

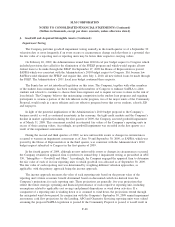

Impairment Testing

The Company performs goodwill impairment testing annually in the fourth quarter as of a September 30

valuation date or more frequently if an event occurs or circumstances change such that there is a potential that

the fair value of a reporting unit or reporting units may be below their respective carrying values.

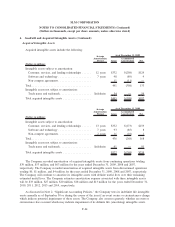

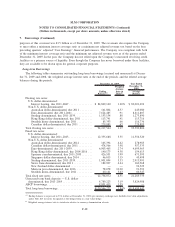

On February 26, 2009, the Administration issued their 2010 fiscal year budget request to Congress which

included provisions that called for the elimination of the FFELP program and which would require all new

federal loans to be made through the DSLP. On September 17, 2009 the House of Representatives passed

SAFRA which was consistent with the Administration’s 2010 budget request to Congress. If it became law

SAFRA would eliminate the FFELP and require that, after July 1, 2010, all new federal loans be made through

the DSLP. The Administration’s 2011 fiscal year budget continued these requests.

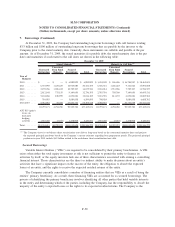

The Senate has not yet introduced legislation on this issue. The Company, together with other members

of the student loan community, has been working with members of Congress to enhance SAFRA to allow

students and schools to continue to choose their loan originator and to require servicers to share in the risk of

loan default. The Company believes that maintaining competition in the student loan programs and requiring

participants to assume a portion of the risk inherent in the program, two of the major tenets of the Community

Proposal, would result in a more efficient and cost effective program better that serves students, schools, ED

and taxpayers.

In light of the potential implications of the Administration’s 2010 budget proposal to the Company’s

business model, as well as continued uncertainty in the economy, the tight credit markets and the Company’s

decline in market capitalization during the first quarter of 2009, the Company assessed goodwill impairment

as of March 31, 2009. This assessment resulted in estimated fair values of the Company’s reporting units in

excess of their carrying values. Accordingly, no goodwill impairment was recorded in the first quarter as a

result of this impairment assessment.

During the second and third quarters of 2009, no new unfavorable events or changes in circumstances

occurred to warrant an impairment assessment as of June 30 and September 30, 2009, as SAFRA, which was

passed by the House of Representatives in the third quarter, was consistent with the Administration’s 2010

budget request submitted to Congress in the first quarter of 2009.

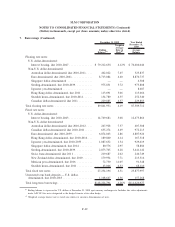

In the fourth quarter of 2009, although no new unfavorable events or changes in circumstances occurred,

the Company retained an appraisal firm to perform its annual Step 1 impairment testing as prescribed in ASC

350, “Intangibles — Goodwill and Other.” Accordingly, the Company engaged the appraisal firm to determine

the fair value of each of its four reporting units to which goodwill was allocated as of September 30, 2009.

The fair value of each reporting unit was determined by weighting different valuation approaches, as

applicable, with the primary approach being the income approach.

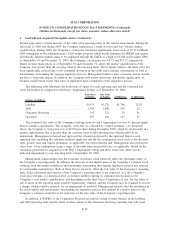

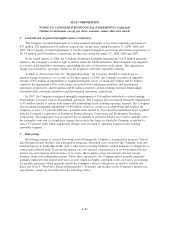

The income approach measures the value of each reporting unit based on the present value of the

reporting unit’s future economic benefit determined based on discounted cash flows derived from the

Company’s projections for each reporting unit. These projections are generally five-year projections that

reflect the future strategic operating and financial performance of each respective reporting unit, including

assumptions related to applicable cost savings and planned dispositions or wind down activities. If a

component of a reporting unit is winding down or is assumed to wind down, the projections extend through

the anticipated wind down period. In conjunction with the Company’s September 30, 2009 annual impairment

assessment, cash flow projections for the Lending, APG and Guarantor Servicing reporting units were valued

assuming the proposed SAFRA legislation is passed. If the Community Proposal is passed, it would result in

F-40

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)