Sallie Mae 2009 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

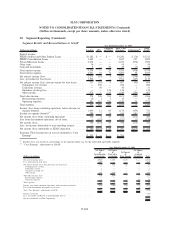

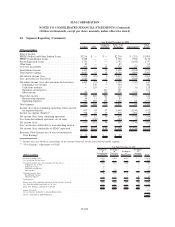

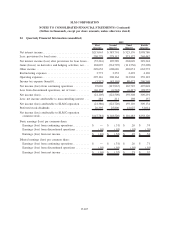

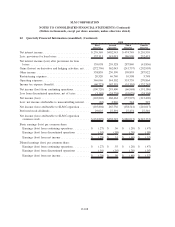

20. Segment Reporting (Continued)

risk-performance underwriting strategies, the addition of qualified cosigners and a combination of higher

interest rates and loan origination fees that compensate the Company for the higher risk.

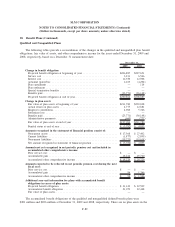

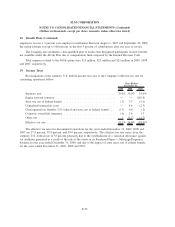

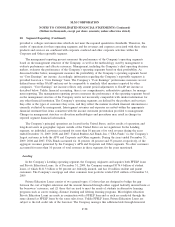

The following table includes asset information for the Company’s Lending business segment.

2009 2008

December 31,

FFELP Stafford and Other Student Loans, net ....................... $ 42,979 $ 44,025

FFELP Stafford Loans Held-for-Sale .............................. 9,696 8,451

FFELP Consolidation Loans, net ................................. 68,379 71,744

Private Education Loans, net .................................... 22,753 20,582

Other loans, net ............................................. 420 729

Cash and investments

(1)

........................................ 12,387 8,445

Retained Interest in off-balance sheet securitized loans................. 1,828 2,200

Other ..................................................... 9,398 9,947

Total assets ................................................. $167,840 $166,123

(1)

Includes restricted cash and investments.

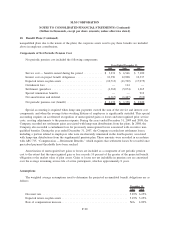

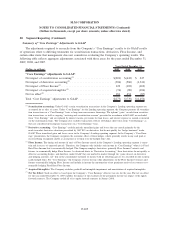

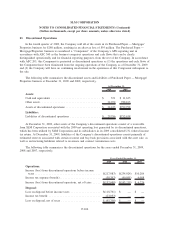

APG

The Company’s APG operating segment provides a wide range of accounts receivable and collections

services including student loan default aversion services, defaulted student loan portfolio management

services, contingency collections services for student loans and other asset classes, accounts receivable

management and collection for purchased portfolios of receivables that are delinquent or have been charged

off by their original creditors, and sub-performing and non-performing mortgage loans. The Company’s APG

operating segment serves the student loan marketplace through a broad array of default management services

on a contingency fee or other pay-for-performance basis to 15 FFELP Guarantors and for campus-based

programs.

In addition to collecting on its own purchased receivables and mortgage loans, the APG operating

segment provides receivable management and collection services for federal agencies, credit card clients and

other holders of consumer debt.

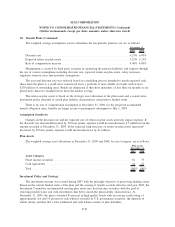

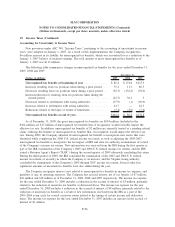

In 2008, the Company concluded that its APG purchased paper businesses were no longer a strategic fit.

The Company sold its international Purchased Paper — Non-Mortgage business in the first quarter of 2009. A

loss of $51 million was recognized in the fourth quarter of 2008 related to this sale as the net assets were held

for sale and carried at the lower of its book basis and fair value as of December 31, 2008. The Company sold

all of the assets in its Purchased Paper — Mortgage/Properties business in the fourth quarter of 2009 (which is

further discussed below), which resulted in an after-tax loss of $95 million. The Company continues to wind

down the domestic side of its Purchased Paper — Non-Mortgage business. The Company will continue to

consider opportunities to sell this business at acceptable prices in the future.

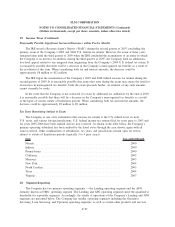

The Company’s domestic Purchased Paper — Non-Mortgage business had certain forward purchase

obligations under which the Company was committed to buy purchased paper through April 2009. The Company

did not purchase any additional purchased paper in excess of these obligations. The Company recognized

F-99

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)