Sallie Mae 2009 Annual Report Download - page 242

Download and view the complete annual report

Please find page 242 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

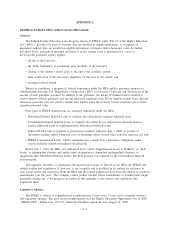

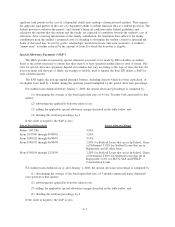

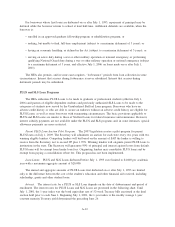

applicant (and parents in the case of a dependent child) must undergo a financial need analysis. This requires

the applicant (and parents in the case of a dependent child) to submit financial data to a federal processor. The

federal processor evaluates the parents’ and student’s financial condition under federal guidelines and

calculates the amount that the student and the family are expected to contribute towards the student’s cost of

education. After receiving information on the family contribution, the institution then subtracts the family

contribution from the student’s estimated costs of attending to determine the student’s need for financial aid.

Some of this need may be met by grants, scholarships, institutional loans and work assistance. A student’s

“unmet need” is further reduced by the amount of loans for which the borrower is eligible.

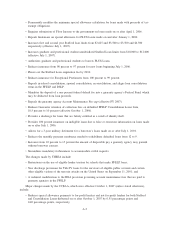

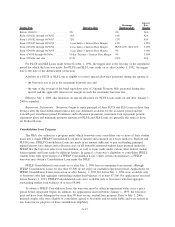

Special Allowance Payments (“SAP”)

The HEA provides for quarterly special allowance payments to be made by ED to holders of student

loans to the extent necessary to ensure that they receive at least specified market interest rates of return. The

rates for special allowance payments depend on formulas that vary according to the type of loan, the date the

loan was made and the type of funds, tax-exempt or taxable, used to finance the loan. ED makes a SAP for

each calendar quarter.

The SAP equals the average unpaid principal balance, including interest which has been capitalized, of

all eligible loans held by a holder during the quarterly period multiplied by the special allowance percentage.

For student loans disbursed before January 1, 2000, the special allowance percentage is computed by:

(1) determining the average of the bond equivalent rates of 91-day Treasury bills auctioned for that

quarter;

(2) subtracting the applicable borrower interest rate;

(3) adding the applicable special allowance margin described in the table below; and

(4) dividing the resultant percentage by 4.

If the result is negative, the SAP is zero.

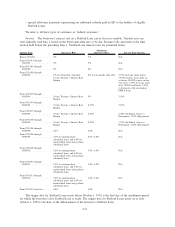

Date of First Disbursement Special Allowance Margin

Before 10/17/86 ............................ 3.50%

From 10/17/86 through 09/30/92 ................ 3.25%

From 10/01/92 through 06/30/95 ................ 3.10%

From 07/01/95 through 06/30/98 ................ 2.50% for Stafford Loans that are in In-School, Grace

or Deferment 3.10% for Stafford Loans that are in

Repayment and all other loans

From 07/01/98 through 12/31/99 ................ 2.20% for Stafford Loans that are in In-School, Grace

or Deferment 2.80% for Stafford Loans that are in

Repayment 3.10% for PLUS, SLS and FFELP

Consolidation Loans

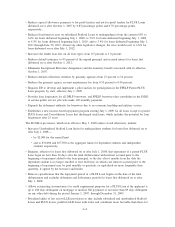

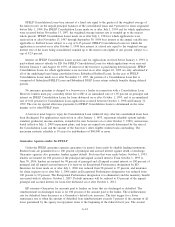

For student loans disbursed on or after January 1, 2000, the special allowance percentage is computed by:

(1) determining the average of the bond equivalent rates of 3-month commercial paper (financial)

rates quoted for that quarter;

(2) subtracting the applicable borrower interest rate;

(3) adding the applicable special allowance margin described in the table below; and

(4) dividing the resultant percentage by 4.

If the result is negative, the SAP is zero.

A-7