Sallie Mae 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

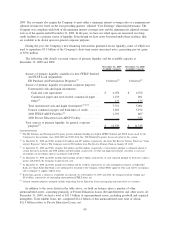

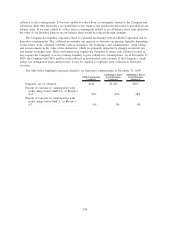

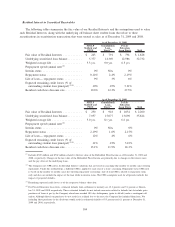

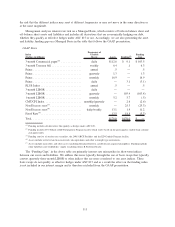

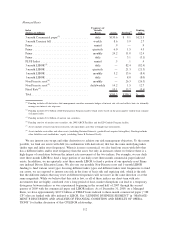

Residual Interest in Securitized Receivables

The following tables summarize the fair value of our Residual Interests and the assumptions used to value

such Residual Interests, along with the underlying off-balance sheet student loans that relate to those

securitizations in securitization transactions that were treated as sales as of December 31, 2009 and 2008.

FFELP

Stafford and

PLUS

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2009

Fair value of Residual Interests ............ $ 243 $ 791 $ 794 $ 1,828

Underlying securitized loan balance ......... 5,377 14,369 12,986 32,732

Weighted average life ................... 3.3yrs. 9.0 yrs. 6.3 yrs

Prepayment speed (annual rate)

(2)

Interim status ......................... 0% N/A 0%

Repayment status ...................... 0-14% 2-4% 2-15%

Life of loan — repayment status ........... 9% 3% 6%

Expected remaining credit losses (% of

outstanding student loan principal)

(3)(4)

. . . . . .10% .25% 5.31%

Residual cash flows discount rate ........... 10.6% 12.3% 27.5%

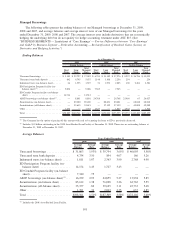

FFELP

Stafford and

PLUS

Consolidation

Loan

Trusts

(1)

Private

Education

Loan Trusts Total

As of December 31, 2008

Fair value of Residual Interests ............ $ 250 $ 918 $ 1,032 $ 2,200

Underlying securitized loan balance ......... 7,057 15,077 13,690 35,824

Weighted average life ................... 3.0yrs. 8.1 yrs. 6.4 yrs.

Prepayment speed (annual rate)

(2)

Interim status ......................... 0% N/A 0%

Repayment status ...................... 2-19% 1-6% 2-15%

Life of loan — repayment status ........... 12% 4% 6%

Expected remaining credit losses (% of

outstanding student loan principal)

(3)(4)

. . . . . .11% .23% 5.22%

Residual cash flows discount rate ........... 13.1% 11.9% 26.3%

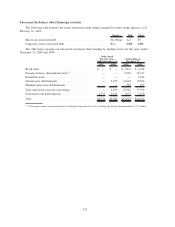

(1)

Includes $569 million and $762 million related to the fair value of the Embedded Floor Income as of December 31, 2009 and

2008, respectively. Changes in the fair value of the Embedded Floor Income are primarily due to changes in the interest rates

and the pay down of the underlying loans.

(2)

The Company uses CPR curves for Residual Interest valuations that are based on seasoning (the number of months since entering

repayment). Under this methodology, a different CPR is applied to each year of a loan’s seasoning. Repayment status CPR used

is based on the number of months since first entering repayment (seasoning). Life of loan CPR is related to repayment status

only and does not include the impact of the loan while in interim status. The CPR assumption used for all periods includes the

impact of projected defaults.

(3)

Remaining expected credit losses as of the respective balance sheet date.

(4)

For Private Education Loan trusts, estimated defaults from settlement to maturity are 12.2 percent and 9.1 percent at Decem-

ber 31, 2009 and 2008, respectively. These estimated defaults do not include recoveries related to defaults but do include prior

purchases of loans at par by the Company when loans reached 180 days delinquency (prior to default) under a contingent call

option. Although these loan purchases do not result in a realized loss to the trust, the Company has included them here. Not

including these purchases in the disclosure would result in estimated defaults of 9.3 percent and 6.1 percent at December 31,

2009 and 2008, respectively.

104