Sallie Mae 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

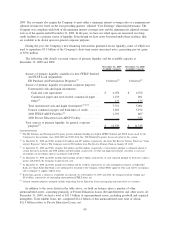

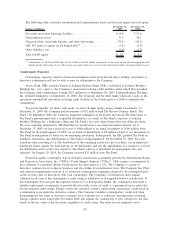

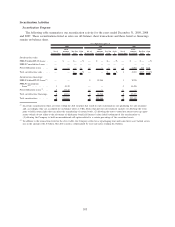

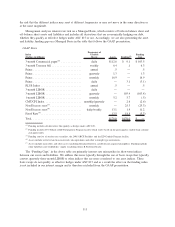

Securitization Activities

Securitization Program

The following table summarizes our securitization activity for the years ended December 31, 2009, 2008

and 2007. Those securitizations listed as sales are off-balance sheet transactions and those listed as financings

remain on-balance sheet.

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

No. of

Transactions

Loan

Amount

Securitized

Pre-Tax

Gain

Gain

%

2009 2008 2007

Years Ended December 31,

Securitizations sales:

FFELP Stafford/PLUS Loans . . . — $ — $— —% — $ — $— —% — $ — $ — —%

FFELP Consolidation Loans . . . — — — — — — — — — — — —

Private Education Loans ...... — — — — — — — — 1 2,001 367 18.4

Total securitizations sales ..... — — $— —% — — $— —% 1 2,001 $367 18.4%

Securitizations financings:

FFELP Stafford/PLUS Loans

(1)

. . — — 9 18,546 3 8,955

FFELP Consolidation

Loans

(1)(2)

............. 3 5,339 — — 5 14,476

Private Education Loans

(1)

..... 5 11,122 — — — —

Total securitizations financings . . 8 16,461 9 18,546 8 23,431

Total securitizations ......... 8 $16,461 9 $18,546 9 $25,432

(1)

In certain securitizations there are terms within the deal structure that result in such securitizations not qualifying for sale treatment

and, accordingly, they are accounted for on-balance sheet as VIEs. Terms that prevent sale treatment include: (1) allowing the Com-

pany to hold certain rights that can affect the remarketing of certain bonds, (2) allowing the trust to enter into interest rate cap agree-

ments (which do not relate to the reissuance of third-party beneficial interests) after initial settlement of the securitization or

(3) allowing the Company to hold an unconditional call option related to a certain percentage of the securitized assets.

(2)

In addition to the transactions listed in the above table, the Company settled on a repackaging trust and issued new asset backed securi-

ties in the amount of $1.0 billion. The debt issued is collateralized by reset rate notes totaling $1.2 billion.

103