Sallie Mae 2009 Annual Report Download - page 169

Download and view the complete annual report

Please find page 169 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

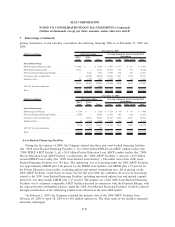

6. Goodwill and Acquired Intangible Assets (Continued)

income approach is a better measure of the value of its reporting units in the current environment. During the

latter half of 2008 and during 2009, the Company experienced a trend of lower and very volatile market

capitalization. During 2009, the Company’s stock price fluctuated significantly from a low of $3.19 in March

2009 subsequent to the Administration’s 2010 budget proposal which would eliminate the FFELP and require

all federally funded students loans to be originated through the DSLP, to a high of $12.00 in December 2009.

At September 30 and December 31, 2009, the Company’s stock price was $8.72 and $11.27, respectively.

Based on these share prices as of September 30 and December 31, alone, the market capitalization of the

Company was greater than the carrying value of the reporting units. The Company believes the share price has

been significantly reduced due to the continued downturn in the credit and economic environment as well as

uncertainties surrounding the ongoing legislative process. Management believes these economic factors should

not have a long-term impact. In addition, the Company will review and revise, potentially significantly, its

business model based on the final form of legislation upon completion of the legislative process.

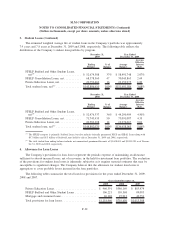

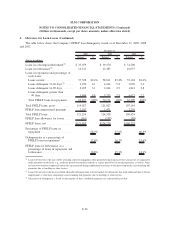

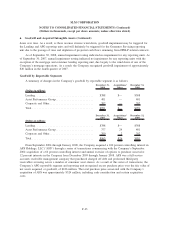

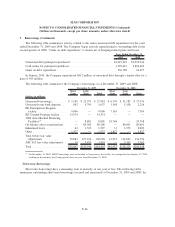

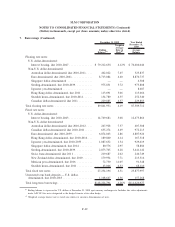

The following table illustrates the book basis of equity for each reporting unit and the estimated fair

value determined in conjunction with Step 1 impairment testing as of September 30, 2009.

Book Basis

of Equity

Fair Value

of Equity $ Difference % Difference

(Dollars in millions)

Lending .............................. $1,474 $3,270 $1,796 122%

APG ................................ 1,390 1,690 300 22

Guarantor Servicing ..................... 142 221 79 56

Upromise ............................. 297 430 133 45

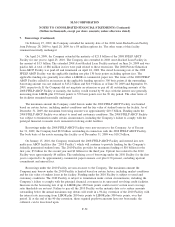

The estimated fair value of the Company resulting from its step 1 impairment test was 41 percent higher

than its market capitalization. The Company views this as a reasonable “control premium.” As discussed

above, the Company’s stock price was at $12.00 per share during December 2009, which by itself results in a

market capitalization that is greater than the carrying value of the reporting units which results in no

impairment. Management reviewed and approved the valuation prepared by the appraisal firm for each

reporting unit, including the valuation methods employed and the key assumptions used, such as the discount

rates, growth rates and control premiums, as applicable, for each reporting unit. Management also performed

stress tests of key assumptions using a range of discount rates and growth rates, as applicable. Based on the

valuations performed in conjunction with Step 1 impairment testing and these stress tests, there was no

indicated impairment for any reporting units at September 30, 2009.

Management acknowledges that the economic slowdown could adversely affect the operating results of

the Company’s reporting units. In addition, the decrease in the market price of the Company’s common stock

resulting from the market turbulence and uncertainty surrounding the ongoing legislative process has reduced

its total market capitalization. Both of these factors adversely affect the fair value of the Company’s reporting

units. If the forecasted performance of the Company’s reporting units is not achieved, or if the Company’s

stock price remains at a depressed level or declines further resulting in continued deterioration in the

Company’s total market capitalization, and depending on the final form of legislation, if any, the fair value of

one or more of the reporting units could be significantly reduced, and the Company may be required to record

a charge, which could be material, for an impairment of goodwill. Management believes that the turbulence in

the stock market and uncertainties surrounding the legislative process has resulted in a market price for the

Company’s common stock that is not indicative of the true value of the Company’s reporting units.

In addition, if SAFRA or the Community Proposal are passed, certain revenue streams in the Lending

and APG reporting units and the entire revenue stream of the Guarantor Servicing reporting unit will wind

F-42

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)