Sallie Mae 2009 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

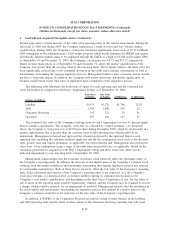

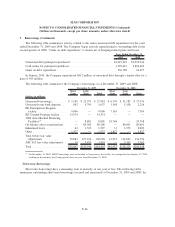

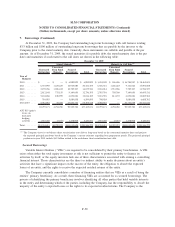

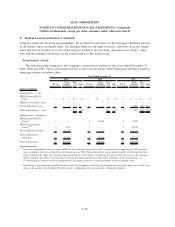

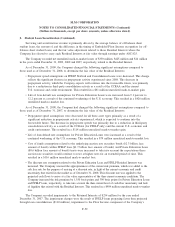

7. Borrowings (Continued)

primary beneficiary of and currently consolidates the following financing VIEs as of December 31, 2009 and

2008:

Short

Term

Long

Term Total Loans Cash Other Assets Total

Debt Outstanding Carrying Amount of Assets Securing Debt

Outstanding

December 31, 2009

(Dollars in millions)

Secured Borrowings:

ED Participation Program facility . . . ............. $9,006 $ — $ 9,006 $ 9,397 $ 115 $ 61 $ 9,573

ED Conduit Program facility . .................. 14,314 — 14,314 14,594 478 372 15,444

2008 Asset-Backed Financing Facilities ............ — 8,801 8,801 9,929 204 100 10,233

On-balance sheet securitizations ................. — 89,200 89,200 93,020 3,627 3,084 99,731

Indentured trusts .......................... 64 1,533 1,597 2,225 172 24 2,421

23,384 99,534 122,918 129,165 4,596 3,641 137,402

ASC 815 fair value adjustment ................. — 1,479 1,479 — — — —

Total . ................................ $23,384 $101,013 $124,397 $129,165 $4,596 $3,641 $137,402

Short

Term

Long

Term Total Loans Cash Other Assets Total

Debt Outstanding Carrying Amount of Assets Securing Debt

Outstanding

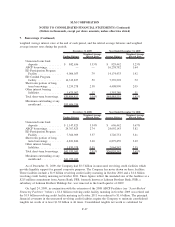

December 31, 2008

(Dollars in millions)

Secured Borrowings:

ED Participation Program . . ................... $7,365 $ — $ 7,365 $ 7,733 $ 88 $ 85 $ 7,906

2008 Asset-Backed Financing Facilities ............. 24,768 — 24,768 31,953 462 816 33,231

On-balance sheet securitizations . . . .............. — 80,601 80,601 81,547 2,632 2,521 86,700

Indentured trusts . . . ........................ 31 1,972 2,003 2,199 236 40 2,475

32,164 82,573 114,737 123,432 3,418 3,462 130,312

ASC 815 fair value adjustment .................. — 872 872 — — — —

Total . ................................. $32,164 $83,445 $115,609 $123,432 $3,418 $3,462 $130,312

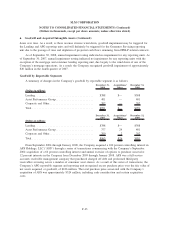

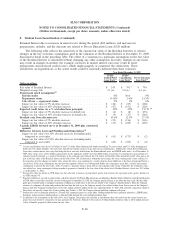

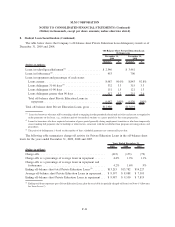

Asset-Backed Financing Facilities

During the first quarter of 2008, the Company entered into three new asset-backed financing facilities

(the “2008 Asset-Backed Financing Facilities”): (i) a $26.0 billion FFELP loan ABCP conduit facility (the

“2008 FFELP ABCP Facility”); (ii) a $5.9 billion Private Education Loan ABCP conduit facility (the “2008

Private Education Loan ABCP Facility”) (collectively, the “2008 ABCP Facilities”); and (iii) a $2.0 billion

secured FFELP loan facility (the “2008 Asset-Backed Loan Facility”). The initial term of the 2008 Asset-

Backed Financing Facilities was 364 days. The underlying cost of borrowing under the 2008 ABCP Facilities

was approximately LIBOR plus 0.68 percent for the FFELP loan facilities and LIBOR plus 1.55 percent for

the Private Education Loan facility, excluding upfront and unused commitment fees. All-in pricing on the

2008 ABCP Facilities varied based on usage. For the full year 2008, the combined, all-in cost of borrowings

related to the 2008 Asset-Backed Financing Facilities, including amortized upfront fees and unused commit-

ment fees, was three-month LIBOR plus 2.47 percent. The primary use of the 2008 Asset-Backed Financing

Facilities was to refinance comparable ABCP facilities incurred in connection with the Proposed Merger, with

the expectation that outstanding balances under the 2008 Asset-Backed Financing Facilities would be reduced

through securitization of the underlying student loan collateral in the term ABS market.

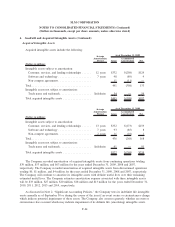

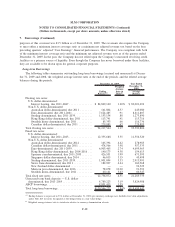

On February 2, 2009, the Company extended the maturity date of the 2008 ABCP Facilities from

February 28, 2009 to April 28, 2009 for a $61 million upfront fee. The other terms of the facilities remained

materially unchanged.

F-51

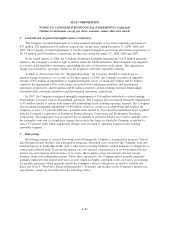

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)