Sallie Mae 2009 Annual Report Download - page 157

Download and view the complete annual report

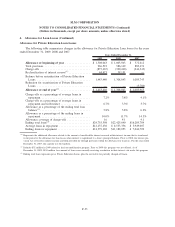

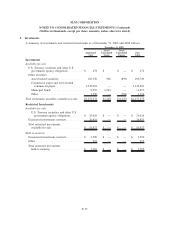

Please find page 157 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.3. Student Loans (Continued)

when the loan was originated and the loan type. The Company earns interest at the greater of the borrower’s

rate or a floating rate based on the SAP formula, with the interest earned on the floating rate that exceeds the

interest earned from the borrower being paid directly by ED. In low or certain declining interest rate

environments when student loans are earning at the fixed borrower rate, and the interest on the funding for the

loans is variable and declining, the Company can earn additional spread income that it refers to as Floor

Income. For loans disbursed after April 1, 2006, FFELP loans effectively only earn at the SAP rate, as the

excess interest earned when the borrower rate exceeds the SAP rate (Floor Income) must be refunded to ED.

FFELP loans are guaranteed as to their principal and accrued interest in the event of default subject to a

Risk Sharing level based on the date of loan disbursement. For loans disbursed after October 1, 1993 and

before July 1, 2006, the Company receives 98 percent reimbursement on all qualifying default claims. For

loans disbursed on or after July 1, 2006, the Company receives 97 percent reimbursement.

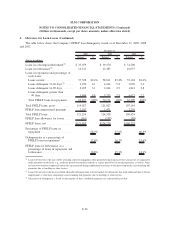

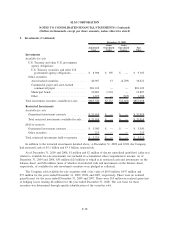

In 2009, the Company sold to ED approximately $18.5 billion face amount of loans as part of the Purchase

Program (approximately $840 million face amount of this amount was sold in the third quarter of 2009, with the

remainder sold in the fourth quarter of 2009). Outstanding debt of $18.5 billion was paid down related to the

Loan Purchase Participation Program (“Participation Program”) pursuant to ECASLA in connection with these

loan sales. These loan sales resulted in a $284 million gain. The settlement of the fourth quarter sale of loans

out of the Participation Program included repaying the debt by delivering the related loans to ED in a non-cash

transaction and receipt of cash from ED for $484 million, representing the reimbursement of a of one-percent

payment made to ED plus a $75 fee per loan.

In December 2008, the Company sold approximately $494 million (principal and accrued interest) of

FFELP loans to ED at a price of 97 percent of principal and unpaid interest pursuant to ED’s authority under

ECASLA to make such purchases, and recorded a loss on the sale. Additionally, in early January 2009, the

Company sold an additional $486 million (principal and accrued interest) in FFELP loans to ED under this

program. The loss related to this sale in January was recognized in 2008 as the loans were classified as

“held-for-sale” under GAAP. The total loss recognized on these two sales for the year ended December 31,

2008 was $53 million and was recorded in “Losses on sales of loans and securities, net” in the consolidated

statements of income.

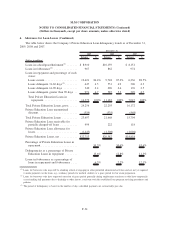

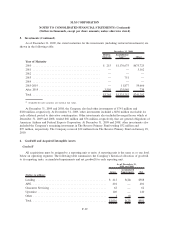

In addition to FFELP loan programs, which place statutory limits on per year and total borrowing, the

Company offers a variety of Private Education Loans. Private Education Loans for post-secondary education and

loans for career training can be subdivided into two main categories: loans that supplement FFELP loans

primarily for higher and lifelong learning programs and loans for career training. For the majority of the Private

Education Loan portfolio, the Company bears the full risk of any losses experienced and, as a result, these loans

are underwritten and priced based upon standardized consumer credit scoring criteria.

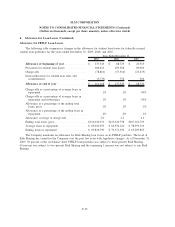

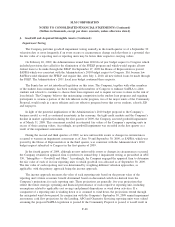

Forbearance involves granting the borrower a temporary cessation of payments (or temporary acceptance

of smaller than scheduled payments) for a specified period of time. Using forbearance in this manner

effectively extends the original term of the loan. Forbearance does not grant any reduction in the total

repayment obligation (principal or interest). While a loan is in forbearance status, interest continues to accrue

and is capitalized to principal when the loan re-enters repayment status. The Company’s forbearance policies

include limits on the number of forbearance months granted consecutively and the total number of forbearance

months granted over the life of the loan. In some instances, the Company requires good-faith payments before

granting forbearance. Exceptions to forbearance policies are permitted when such exceptions are judged to

increase the likelihood of ultimate collection of the loan. Forbearance as a collection tool is used most

F-30

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)