Sallie Mae 2009 Annual Report Download - page 182

Download and view the complete annual report

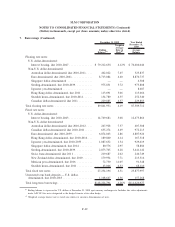

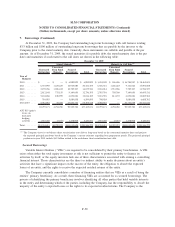

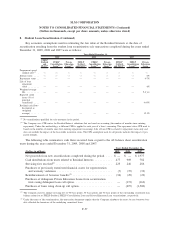

Please find page 182 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7. Borrowings (Continued)

becomes less than probable the Company will call these bonds at a future date, it will result in the Company

reversing this prior accretion as a cumulative catch up adjustment. The Company has accreted approximately

$59 million as a reduction of interest expense through December 31, 2009.

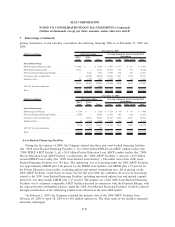

During 2009 and 2008, five and two, respectively, of the Company’s off-balance sheet securitization trusts

were re-evaluated and it was determined that they no longer met the criteria to be considered QSPEs. These

trusts were then evaluated as VIEs and it was determined that they should be consolidated and accounted for

as secured borrowings as the Company is the primary beneficiary. These trusts had reached their 10 percent

clean-up call levels but the call was not exercised by the Company. Because the Company can now exercise

that option at its discretion going forward, the Company effectively controls the assets of the trusts. This

resulted in the Company consolidating at fair value $685 million and $289 million in assets and $649 million

and $278 million in liabilities related to these trusts during 2009 and 2008, respectively. This resulted in

$20 million and $2 million recognized gains in 2009 and 2008, respectively.

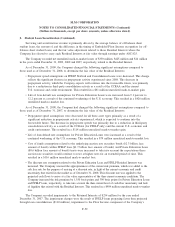

Auction Rate Securities

At December 31, 2009, the Company had $1.0 billion of taxable and $1.1 billion of tax-exempt auction

rate securities outstanding in on-balance sheet securitizations and indentured trusts, respectively. Since

February 2008, problems in the auction rate securities market as a whole led to failures of the auctions

pursuant to which certain of the Company’s auction rate securities’ interest rates are set. As a result, all of the

Company’s auction rate securities as of December 31, 2009 bore interest at the maximum rate allowable under

their terms. The maximum allowable interest rate on the Company’s $1.0 billion of taxable auction rate

securities is generally LIBOR plus 1.50 percent. The maximum allowable interest rate on many of the

Company’s $1.1 billion of tax-exempt auction rate securities is a formula driven rate, which produced various

maximum rates up to 1.14 percent during the fourth quarter of 2009. Since December 31, 2009, certain of the

Company’s taxable auction rate securities with shorter terms to maturity have had successful auctions.

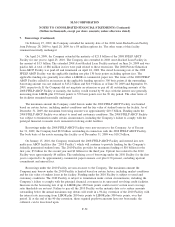

Indentured Trusts

The Company has secured assets and outstanding bonds in indentured trusts resulting from the acquisition

of various student loan providers in prior periods. The indentures were created and bonds issued to finance the

acquisition of student loans guaranteed under the Higher Education Act. The bonds are limited obligations of

the Company and are secured by and payable from payments associated with the underlying secured loans.

Federal Home Loan Bank in Des Moines

On January 15, 2010, HICA Education Loan Corporation, a subsidiary of the Company, entered into a

lending agreement with the Federal Home Loan Bank of Des Moines (the “FHLB”). Under the agreement, the

FHLB will provide advances backed by Federal Housing Finance Agency approved collateral including

federally-guaranteed student loans. The initial borrowing of $25 million at a rate of .23 percent under this

facility occurred on January 15, 2010 and matured on January 22, 2010. The amount, price and tenor of future

advances will vary and will be determined at the time of each borrowing. The maximum amount that can be

borrowed, as of January 15, 2010, subject to available collateral, is approximately $11 billion. The Company

has provided a guarantee to the FHLB for the performance and payment of HICA’s obligations.

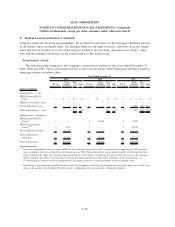

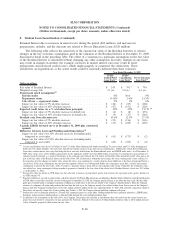

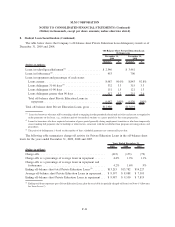

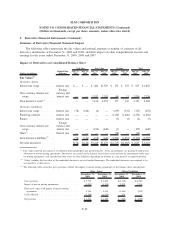

8. Student Loan Securitization

The Company securitizes its FFELP Stafford Loans, FFELP Consolidation Loans and Private Education

Loan assets and, for transactions qualifying as sales, retains a Residual Interest and servicing rights (as the

F-55

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)