Sallie Mae 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

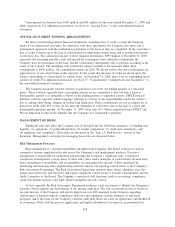

the risk that the different indices may reset at different frequencies or may not move in the same direction or

at the same magnitude.

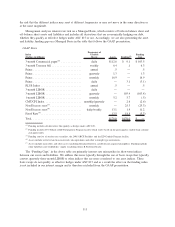

Management analyzes interest rate risk on a Managed Basis, which consists of both on-balance sheet and

off-balance sheet assets and liabilities and includes all derivatives that are economically hedging our debt,

whether they qualify as effective hedges under ASC 815 or not. Accordingly, we are also presenting the asset

and liability funding gap on a Managed Basis in the table that follows the GAAP presentation.

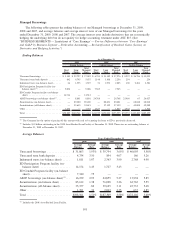

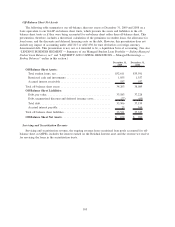

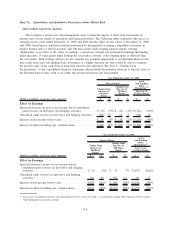

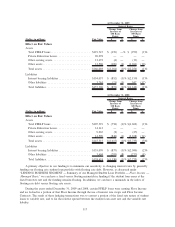

GAAP Basis

Index

(Dollars in billions)

Frequency of

Variable

Resets Assets Funding

(1)

Funding

Gap

3-month Commercial paper

(2)

............. daily $112.6 $ 9.1 $ 103.5

3-month Treasury bill ................... weekly 6.4 .1 6.3

Prime ............................... annual .5 — .5

Prime ............................... quarterly 1.3 — 1.3

Prime ............................... monthly 16.9 — 16.9

Prime ............................... daily — 3.1 (3.1)

PLUS Index .......................... annual .5 — .5

3-month LIBOR ....................... daily — — —

3-month LIBOR ....................... quarterly — 103.4 (103.4)

1-month LIBOR ....................... monthly 5.2 5.7 (.5)

CMT/CPI Index ....................... monthly/quarterly — 2.6 (2.6)

Non-Discrete reset

(3)

.................... monthly — 25.3 (25.3)

Non-Discrete reset

(4)

.................... daily/weekly 13.1 1.9 11.2

Fixed Rate

(5)

.......................... 13.5 18.8 (5.3)

Total................................ $170.0 $170.0 $ —

(1)

Funding includes all derivatives that qualify as hedges under ASC 815.

(2)

Funding includes $9.0 billion of ED Participation Program facility which resets based on the prior quarter student loan commer-

cial paper index.

(3)

Funding consists of auction rate securities, the 2008 ABCP Facilities and the ED Conduit Program facility.

(4)

Assets include restricted and non-restricted cash equivalents and other overnight type instruments.

(5)

Assets include receivables and other assets (including Retained Interests, goodwill and acquired intangibles). Funding includes

other liabilities and stockholders’ equity (excluding Series B Preferred Stock).

The “Funding Gaps” in the above table are primarily interest rate mismatches in short-term indices

between our assets and liabilities. We address this issue typically through the use of basis swaps that typically

convert quarterly three-month LIBOR to other indices that are more correlated to our asset indices. These

basis swaps do not qualify as effective hedges under ASC 815 and as a result the effect on the funding index

is not included in our interest margin and is therefore excluded from the GAAP presentation.

111