Sallie Mae 2009 Annual Report Download - page 208

Download and view the complete annual report

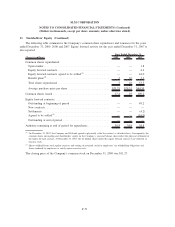

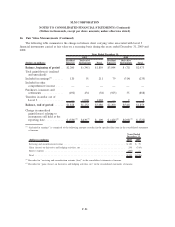

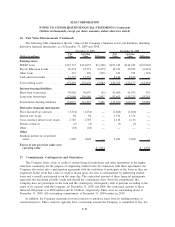

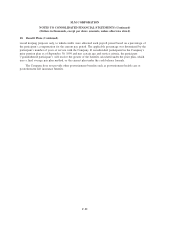

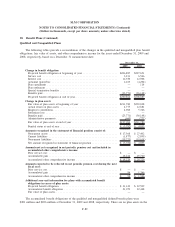

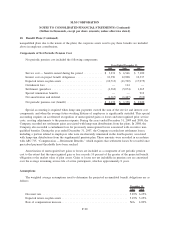

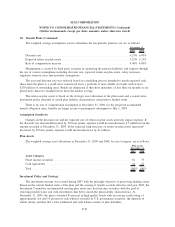

Please find page 208 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16. Fair Value Measurements (Continued)

Repayment Borrower Benefits to be earned. In addition, the Floor Income component of the Company’s

FFELP loan portfolio is valued through discounted cash flow and option models using both observable market

inputs and internally developed inputs. A number of significant inputs into the models are internally derived

and not observable to market participants.

Other Loans

Facilities financings, and mortgage and consumer loans held for investment are accounted for at cost with

fair values being disclosed. Mortgage loans held for sale are accounted for at lower of cost or market. Fair

value was determined with discounted cash flow models using the stated terms of the loans and observable

market yield curves. In addition, adjustments and assumptions were made for credit spreads, liquidity,

prepayment speeds and defaults. A number of significant inputs into the models are not observable.

Cash and Investments (Including “Restricted”)

Cash and cash equivalents are carried at cost. Carrying value approximated fair value for disclosure

purposes. Investments are classified as trading or available-for-sale are carried at fair value in the financial

statements. Investments in U.S. Treasury securities and securities issued by U.S. government agencies that are

traded in active markets were valued using observable market prices. Other investments for which observable

prices from active markets are not available were valued through standard bond pricing models using

observable market yield curves adjusted for credit and liquidity spreads. The fair value of investments in

Commercial Paper, Asset Backed Commercial Paper, or Demand Deposits that have a remaining term of less

than 90 days when purchased are estimated at cost and, when needed, adjustments for liquidity and credit

spreads are made depending on market conditions and counterparty credit risks. These investments consist of

mostly overnight/weekly maturity instruments with highly-rated counterparties.

Borrowings

Borrowings are accounted for at cost in the financial statements except when denominated in a foreign

currency or when designated as the hedged item in a fair value hedge relationship. When the hedged risk is

the benchmark interest rate and not full fair value, the cost basis is adjusted for changes in value due to

benchmark interest rates only. Additionally, foreign currency denominated borrowings are re-measured at

current spot rates in the financial statements. The full fair value of all borrowings is disclosed. Fair value was

determined through standard bond pricing models and option models (when applicable) using the stated terms

of the borrowings, observable yield curves, foreign currency exchange rates, volatilities from active markets or

from quotes from broker-dealers. Credit adjustments for unsecured corporate debt are made based on

indicative quotes from observable trades and spreads on credit default swaps specific to the Company. Credit

adjustments for secured borrowings are based on indicative quotes from broker-dealers. These adjustments for

both secured and unsecured borrowings are material to the overall valuation of these items and, currently, are

based on inputs from inactive markets.

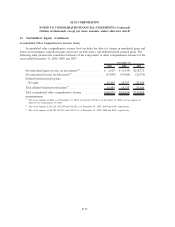

Derivative Financial Instruments

All derivatives are accounted for at fair value in the financial statements. The fair values of a majority of

derivative financial instruments, including swaps and floors, were determined by standard derivative pricing

and option models using the stated terms of the contracts and observable yield curves, forward foreign

currency exchange rates and volatilities from active markets. In some cases, management utilized internally

developed amortization streams to model the fair value for swaps whose notional amounts contractually

amortizes with securitized asset balances. Complex structured derivatives or derivatives that trade in less liquid

F-81

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)