Sallie Mae 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

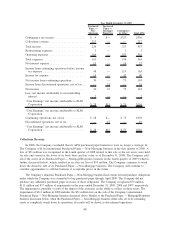

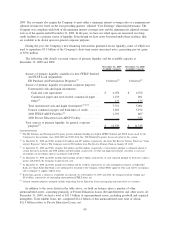

Purchased

Paper —

Non-

Mortgage

Purchased

Paper —

Mortgage/

Properties

Contingency

& Other Total APG

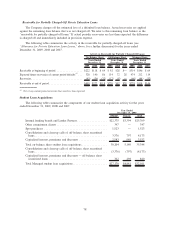

Year Ended December 31, 2007

Contingency fee income .................... $ 9 $— $327 $336

Collections revenue ....................... 217 — — 217

Total income ............................ 226 — 327 553

Restructuring expenses ..................... 1 — 1 2

Operating expenses........................ 164 — 197 361

Total expenses ........................... 165 — 198 363

Net interest expense ....................... 13 — 14 27

Income from continuing operations before income

tax expense ........................... 48 — 115 163

Income tax expense ....................... 18 — 42 60

Net income from continuing operations ......... 30 — 73 103

Income from discontinued operations, net of tax . . — 15 — 15

Net income ............................. 30 15 73 118

Less: net income attributable to noncontrolling

interest ............................... 2 — — 2

“Core Earnings” net income attributable to SLM

Corporation ........................... $ 28 $15 $ 73 $116

“Core Earnings” net income attributable to SLM

Corporation:

Continuing operations, net of tax . ............ $ 28 $— $ 73 $101

Discontinued operations, net of tax ............ — 15 — 15

“Core Earnings” net income attributable to SLM

Corporation ........................... $ 28 $15 $ 73 $116

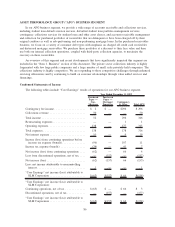

Collections Revenue

In 2008, the Company concluded that its APG purchased paper businesses were no longer a strategic fit.

The Company sold its international Purchased Paper — Non-Mortgage business in the first quarter of 2009. A

loss of $51 million was recognized in the fourth quarter of 2008 related to this sale as the net assets were held

for sale and carried at the lower of its book basis and fair value as of December 31, 2008. The Company sold

all of the assets in its Purchased Paper — Mortgage/Properties business in the fourth quarter of 2009 (which is

further discussed below), which resulted in an after-tax loss of $95 million. The Company continues to wind

down the domestic side of its Purchased Paper — Non-Mortgage business. The Company will continue to

consider opportunities to sell this business at acceptable prices in the future.

The Company’s domestic Purchased Paper — Non-Mortgage business had certain forward purchase obligations

under which the Company was committed to buy purchased paper through April 2009. The Company did not

purchase any additional purchased paper in excess of these obligations. The Company recognized $79 million,

$111 million and $17 million of impairments in the years ended December 31, 2009, 2008 and 2007, respectively.

The impairment is primarily a result of the impact of the economy on the ability to collect on these assets. The

impairment of $111 million in 2008 includes the $51 million loss on the sale of the Company’s international

Purchased Paper — Non-Mortgage business discussed above. Similar to the Purchased Paper — Mortgage/Properties

business discussion below, when the Purchased Paper — Non-Mortgage business either sells all of its remaining

assets or completely winds down its operations, its results will be shown as discontinued operations.

88