Sallie Mae 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

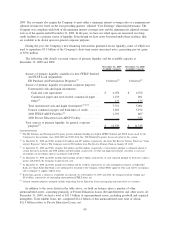

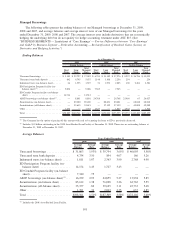

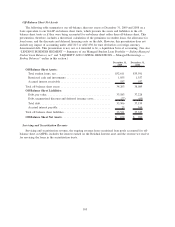

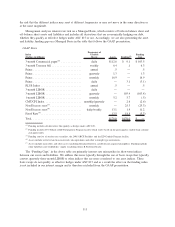

The following table summarizes the components of servicing and securitization revenue for the years

ended December 31, 2009, 2008 and 2007.

2009 2008 2007

Years Ended December 31,

Servicing revenue ..................................... $ 226 $ 247 $ 285

Securitization revenue, before net Embedded Floor Income,

impairment and unrealized fair value adjustment ............. 309 323 419

Servicing and securitization revenue, before net Embedded Floor

Income, impairment and unrealized fair value adjustment ...... 535 570 704

Embedded Floor Income ................................ 284 191 20

Less: Floor Income previously recognized in gain calculation ..... (214) (76) (9)

Net Embedded Floor Income ............................. 70 115 11

Servicing and securitization revenue, before impairment and

unrealized fair value adjustment ......................... 605 685 715

Unrealized fair value adjustment .......................... (330) (425) (24)

Gain on consolidation of off-balance sheet trusts .............. 20 2 —

Retained Interest impairment ............................. — — (254)

Total servicing and securitization revenue .................... $ 295 $ 262 $ 437

Average off-balance sheet student loans ..................... $34,414 $37,586 $42,411

Average balance of Retained Interest ....................... $ 1,911 $ 2,596 $ 3,385

Servicing and securitization revenue as a percentage of the average

balance of off-balance sheet student loans .................. .86% .70% 1.03%

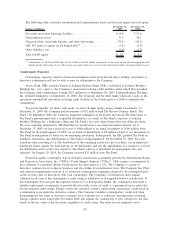

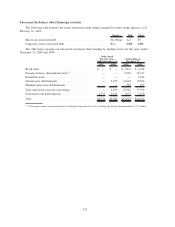

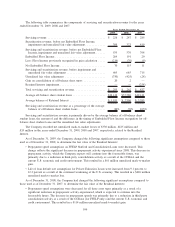

Servicing and securitization revenue is primarily driven by the average balance of off-balance sheet

student loans, the amount of and the difference in the timing of Embedded Floor Income recognition for off-

balance sheet student loans and the unrealized fair value adjustments.

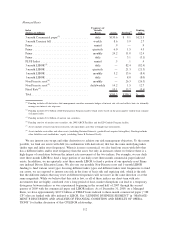

The Company recorded net unrealized mark-to-market losses of $330 million, $425 million and

$24 million in the years ended December 31, 2009, 2008 and 2007, respectively, related to the Residual

Interest.

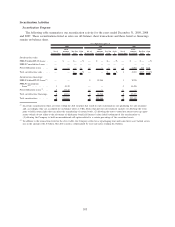

As of December 31, 2009, the Company changed the following significant assumptions compared to those

used as of December 31, 2008, to determine the fair value of the Residual Interests:

• Prepayment speed assumptions on FFELP Stafford and Consolidation Loans were decreased. This

change reflects the significant decrease in prepayment activity experienced since 2008. This decrease in

prepayment activity, which the Company expects will continue into the foreseeable future, was

primarily due to a reduction in third-party consolidation activity as a result of the CCRAA and the

current U.S. economic and credit environment. This resulted in a $61 million unrealized mark-to-market

gain.

• Life of loan default rate assumptions for Private Education Loans were increased from 9.1 percent to

12.2 percent as a result of the continued weakening of the U.S. economy. This resulted in a $426 million

unrealized mark-to-market loss.

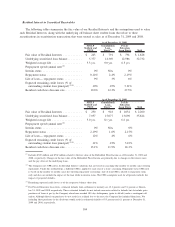

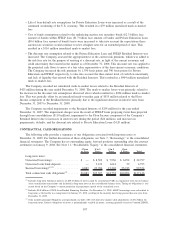

As of December 31, 2008, the Company had changed the following significant assumptions compared to

those used as of December 31, 2007, to determine the fair value of the Residual Interests:

• Prepayment speed assumptions were decreased for all three asset types primarily as a result of a

significant reduction in prepayment activity experienced, which is expected to continue into the

foreseeable future. The decrease in prepayment speeds was primarily due to a reduction in third-party

consolidation activity as a result of the CCRAA (for FFELP only) and the current U.S. economic and

credit environment. This resulted in a $114 million unrealized mark-to-market gain.

106