Sallie Mae 2009 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

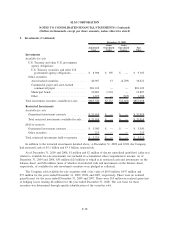

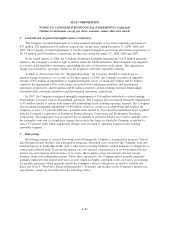

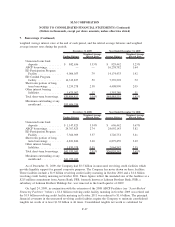

7. Borrowings (Continued)

purposes of this covenant was $3.5 billion as of December 31, 2009. The covenants also require the Company

to meet either a minimum interest coverage ratio or a minimum net adjusted revenue test based on the four

preceding quarters’ adjusted “Core Earnings” financial performance. The Company was compliant with both

of the minimum interest coverage ratio and the minimum net adjusted revenue tests as of the quarter ended

December 31, 2009. In the past, the Company has not relied upon the Company’s unsecured revolving credit

facilities as a primary source of liquidity. Even though the Company has never borrowed under these facilities,

they are available to be drawn upon for general corporate purposes.

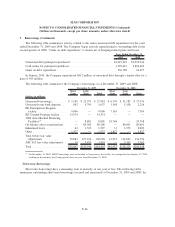

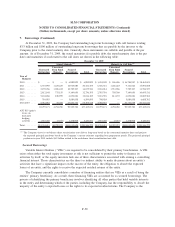

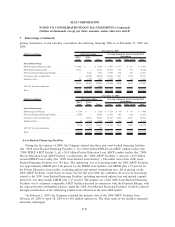

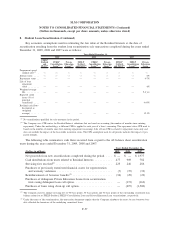

Long-term Borrowings

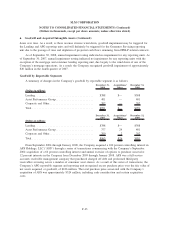

The following tables summarize outstanding long-term borrowings (secured and unsecured) at Decem-

ber 31, 2009 and 2008, the weighted average interest rates at the end of the periods, and the related average

balances during the periods.

Ending

Balance

(1)

Weighted

Average

Interest

Rate

(2)

Average

Balance

Year Ended

December 31,

2009

December 31, 2009

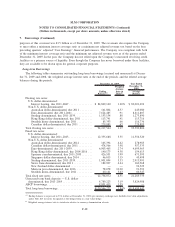

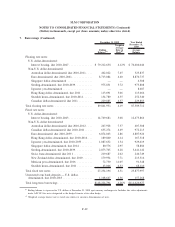

Floating rate notes:

U.S. dollar-denominated:

Interest bearing, due 2011-2047 ............... $ 84,849,160 1.20% $ 83,001,692

Non-U.S. dollar-denominated:

Australian dollar-denominated, due 2011 ........ 161,804 4.57 443,080

Euro-denominated, due 2011-2041 ............. 7,624,485 .91 8,411,807

Sterling-denominated, due 2011-2039 ........... 1,153,134 .88 1,273,890

Hong Kong dollar-denominated, due 2011 ....... 113,741 .41 113,716

Swedish krona-denominated, due 2011 .......... 85,353 .66 116,736

Canadian dollar-denominated, due 2011 ......... 229,885 .67 229,885

Total floating rate notes ........................ 94,217,562 1.17 93,590,806

Fixed rate notes:

U.S. dollar-denominated:

Interest bearing, due 2011-2043 ............... 12,355,688 5.55 11,556,520

Non-U.S.-dollar denominated:

Australian dollar-denominated, due 2012 ........ 165,394 4.42 278,983

Canadian dollar-denominated, due 2011 ......... 478,566 3.98 557,333

Euro-denominated, due 2011-2039 ............. 6,903,465 2.74 4,695,963

Hong Kong dollar-denominated, due 2014-2016 . . . 140,173 4.38 154,613

Japanese yen-denominated, due 2011-2035 ....... 426,551 1.99 671,595

Singapore dollar-denominated, due 2014 ........ 46,015 3.15 45,498

Sterling-denominated, due 2011-2039 ........... 1,901,094 5.33 2,913,991

Swiss franc-denominated, due 2011 ............ 182,907 2.24 160,568

New Zealand dollar-denominated .............. — — 96,529

Mexican peso-denominated, due 2016 .......... 78,078 10.30 91,593

Swedish krona-denominated, due 2011 .......... 60,141 3.63 60,547

Total fixed rate notes .......................... 22,738,072 4.51 21,283,733

Unsecured term bank deposits — U.S. dollar-

denominated, due 2011-2019 ................... 4,789,223 3.19 3,824,908

ABCP borrowings ............................. 8,801,415 1.55 —

Total long-term borrowings . . .................... $130,546,272 1.84% $118,699,447

(1)

Ending balance is expressed in U.S. dollars at December 31, 2009 spot currency exchange rate. Includes fair value adjustments

under ASC 815 for notes designated as the hedged item in a fair value hedge.

(2)

Weighted average interest rate is stated rate relative to currency denomination of note.

F-48

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)