Sallie Mae 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Administration’s 2010 fiscal year budget also called for the hiring of additional loan servicers to help

ease the transition to a full DSLP and to handle the significant increase in future volume. On June 17, 2009,

we announced that we were selected by ED as one of four private sector servicers awarded a servicing contract

(the “ED Servicing Contract”) to service loans we sell to ED plus a portion of loans others sell to ED, existing

DSLP loans and loans originated in the future. We began servicing loans under this contract in the third

quarter of 2009.

Under both SAFRA and the Community Proposal, the Company would no longer originate, fund or hold

new FFELP loans to earn a net interest margin. However, the Company would continue to earn net interest

income from our portfolio of existing FFELP loans as the portfolio runs off over a period of time. The

Company would become a fee for service provider in the federal loan business. We will continue to originate,

fund and hold Private Education Loans.

In addition, the legislation would eliminate the need for the Guarantors and the services we provide to the

sector. The Company earns a fee when it processes a loan guarantee for a Guarantor client for the life of the

loan for servicing the Guarantor’s portfolio of loans. If either SAFRA or the Community Proposal become

laws, we would no longer earn the origination fee paid by Guarantors. The portfolio that generates the

maintenance fee would go into run-off and we would continue to earn the maintenance fee and perform the

associated default aversion and prevention work for the remaining life of the loans. In 2009, we earned

guarantor servicing fees of $136 million, which was approximately evenly split between origination and

maintenance fees.

Our student loan contingent collection business would also be impacted by the pending legislation. We

currently have 12 Guarantors and ED as clients. We earn revenue from Guarantors for collecting defaulted

loans as well as for managing their portfolios of defaulted loans. Revenue from Guarantor clients is

approximately 66 percent of our contingent collection revenue. We anticipate that revenue from Guarantors

will be relatively stable through 2012 and then begin to steadily decline if either SAFRA or the Community

Proposal are adopted.

The Company, through its subsidiary Pioneer Credit, has been collecting defaulted student loans on behalf of

ED since 1997. The contract is merit based and accounts are awarded on collection performance. Pioneer Credit has

consistently ranked number one or two among the ED collectors. In anticipation of a surge in volume as more loans

switch to DSLP, ED recently added five new collection companies bringing the total to 22. This led to a decline in

account placements with Pioneer Credit, which we believe is temporary. The Company expects that as the DSLP

grows the decline in revenue we would experience from our Guarantor clients would be partially offset by increased

revenue under the ED contract in future years.

If SAFRA becomes law, a significant restructuring which would result in significant job losses throughout

the Company and we will be required to adapt to our new business environment.

The Company is exploring available liquidity to fund FFELP loans for our student customers if legislation

is not passed and The Ensuring Continued Access to Student Loans Act of 2008 (“ECASLA”) is not extended

in time for the academic year (“AY”) 2010 — 2011. We believe that adequate liquidity will be available to

fund the anticipated number of loans.

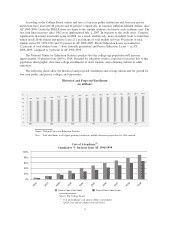

Student Lending Market

Students and their families use multiple sources of funding to pay for their college education, including

savings, current income, grants, scholarships, and federally guaranteed and private education loans. Over the

last five years, these sources of funding for higher education have been relatively stable with a general trend

towards an increased use of student loans. In the last academic year, 39 percent of students used federally

guaranteed student loans or private education loans to finance their education. Due to an increase in federal

loan limits that took effect in 2007 and 2008, the Company has seen a substantial increase in borrowing from

federal loan programs in recent years.

3