Sallie Mae 2009 Annual Report Download - page 150

Download and view the complete annual report

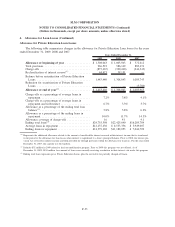

Please find page 150 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Significant Accounting Policies (Continued)

non-performing mortgage loans in accordance with ASC 310. Under ASC 310, the Company establishes static

pools of each quarter’s purchases and aggregates them based on common risk characteristics. The pools when

formed are initially recorded at fair value, based on each pool’s estimated future cash flows and internal rate

of return. The Company recognizes income each month based on each static pool’s effective interest rate. The

static pools are tested quarterly for impairment by re-estimating the future cash flows to be received from the

pools. If the new estimated cash flows result in a pool’s effective interest rate increasing, then this new yield

is used prospectively over the remaining life of the static pool. If the new estimated cash flows result in a

pool’s effective interest rate decreasing, the pool is impaired and written down through a valuation allowance

to maintain the effective interest rate. The Company recognized $79 million and $111 million of impairments

for the years ended December 31, 2009 and 2008, respectively, as discussed in Note 20, “Segment Reporting.”

Net interest income earned, less any impairments recognized, on the purchased portfolios is recorded as

collection revenue in the consolidated statements of income. When mortgage loans default and the Company

forecloses and owns the underlying real estate, the Company carries such real estate at the lower of cost or

fair value. There is approximately $285 million on the balance sheet as of December 31, 2009 related to

purchased paper assets.

Restructuring Activities

From time to time, the Company implements plans to restructure its business. In conjunction with these

restructuring plans, one-time, involuntary benefit arrangements, disposal costs (including contract termination

costs and other exit costs), as well as certain other costs that are incremental and incurred as a direct result of

the Company’s restructuring plans, are accounted for in accordance with ASC 420, “Exit or Disposal Cost

Obligations,” and are classified as restructuring expenses in the accompanying consolidated statements of

income.

In conjunction with its restructuring plans, the Company has entered into one-time benefit arrangements

with employees, primarily senior executives, who have been involuntarily terminated. The Company recog-

nizes a liability when all of the following conditions have been met and the benefit arrangement has been

communicated to the employees:

• Management, having the authority to approve the action, commits to a plan of termination;

• The plan of termination identifies the number of employees to be terminated, their job classifications or

functions and their locations and the expected completion date;

• The plan of termination establishes the terms of the benefit arrangement, including the benefits that

employees will receive upon termination, in sufficient detail to enable employees to determine the type

and amount of benefits they will receive if they are involuntarily terminated; and

• Actions required to complete the plan of termination indicate that it is unlikely that significant changes

to the plan of termination will be made or that the plan of termination will be withdrawn.

Severance costs under such one-time termination benefit arrangements may include all or some combina-

tion of severance pay, medical and dental benefits, outplacement services, and certain other costs.

Contract termination costs are expensed at the earlier of (1) the contract termination date or (2) the cease

use date under the contract. Other exit costs are expensed as incurred and classified as restructuring expenses

if (1) the cost is incremental to and incurred as a direct result of planned restructuring activities, and (2) the

cost is not associated with or incurred to generate revenues subsequent to the Company’s consummation of the

related restructuring activities.

F-23

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)