Sallie Mae 2009 Annual Report Download - page 13

Download and view the complete annual report

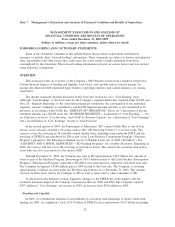

Please find page 13 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.quarter of 2008. It subsequently reverted to more normal levels beginning in the third quarter of 2009 and has been

stable since then. In such circumstances, our earnings could be adversely affected, possibly to a material extent.

Our credit ratings are important to our liquidity. A reduction in our credit ratings could adversely affect

our liquidity, increase our borrowing costs, limit our access to the markets or trigger obligations under certain

provisions in collateralized arrangements. Under these provisions, counterparties may require us to segregate

collateral or terminate certain contracts.

Economic Conditions.

We may be adversely affected by deterioration in economic conditions.

We may continue to be adversely affected by economic conditions. A continuation of the current downturn

in the economy, or a further deterioration, could result in lessened demand for consumer credit and credit quality

could continue to be impacted. Adverse economic conditions may result in declines in collateral values. Higher

credit-related losses and weaker credit quality could impact our financial position and limit funding options,

including capital markets activity, which could adversely impact the Company’s liquidity position.

Operations.

A failure of our operational systems or infrastructure, or those of our third-party vendors, could disrupt our

business, result in disclosure of confidential customer information, damage our reputation and cause losses.

A failure of our operational systems or infrastructure, or those of our third-party vendors, could disrupt our

business. Our business is dependent on our ability to process and monitor, on a daily basis, a large number of

transactions. These transactions must be processed in compliance with legal and regulatory standards and our

product specifications, which we change to reflect our business needs. As processing demands change and grow,

developing and maintaining our operational systems and infrastructure becomes increasingly challenging.

Our loan originations and servicing, financial, accounting, data processing or other operating systems and

facilities may fail to operate properly or become disabled as a result of events that are beyond our control,

adversely affecting our ability to process these transactions. Any such failure could adversely affect our ability

to service our clients, result in financial loss or liability to our clients, disrupt our business, result in regulatory

action or cause reputational damage. Despite the plans and facilities we have in place, our ability to conduct

business may be adversely impacted by a disruption in the infrastructure that supports our businesses. This

may include a disruption involving electrical, communications, internet, transportation or other services used

by us or third parties with which we conduct business. Notwithstanding our efforts to maintain business

continuity, a disruptive event impacting our processing locations could negatively affect our business.

Our operations rely on the secure processing, storage and transmission of personal, confidential and other

information in our computer systems and networks. Although we take protective measures, our computer

systems, software and networks may be vulnerable to unauthorized access, computer viruses, malicious attacks

and other events that could have a security impact beyond our control. If one or more of such events occur,

personal, confidential and other information processed and stored in, and transmitted through, our computer

systems and networks, could be jeopardized or otherwise interruptions or malfunctions in our operations could

result in significant losses or reputational damage. We may be required to expend significant additional

resources to modify our protective measures or to investigate and remediate vulnerabilities or other exposures,

and we may be subject to litigation and financial losses that are either not insured against or not fully covered

through any insurance maintained by us.

We routinely transmit and receive personal, confidential and proprietary information, some through third

parties. We have put in place secure transmission capability, and work to ensure third parties follow similar

procedures. An interception, misuse or mishandling of personal, confidential or proprietary information being sent

to or received from a customer or third party could result in legal liability, regulatory action and reputational harm.

12