Sallie Mae 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

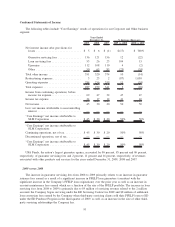

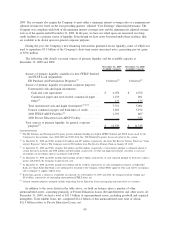

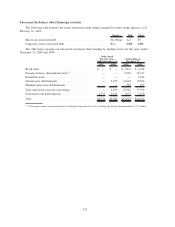

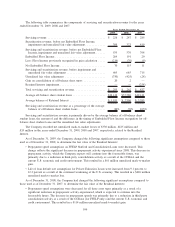

The following table reconciles encumbered and unencumbered assets and their net impact on total equity.

(Dollars in billions)

December 31,

2009

December 31,

2008

Net assets in secured financing facilities ........................ $14.5 $ 15.6

Unencumbered assets ...................................... 31.3 36.1

Unsecured debt, term bank deposits, and other borrowings .......... (35.1) (42.1)

ASC 815 mark-to-market on all hedged debt

(1)

................... (3.4) (3.4)

Other liabilities, net ....................................... (2.0) (1.2)

Total GAAP equity ....................................... $ 5.3 $ 5.0

(1)

At December 31, 2009 and 2008, there are $3.4 billion and $3.6 billion, respectively, of net gains on derivatives hedging this debt,

which partially offsets these losses. These gains are a part of the net assets in secured financing facilities and unencumbered assets.

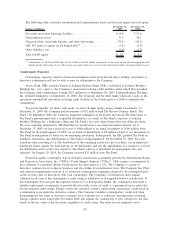

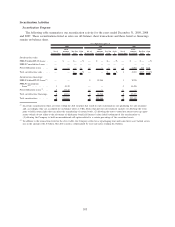

Counterparty Exposure

Counterparty exposure related to financial instruments arises from the risk that a lending, investment or

derivative counterparty will not be able to meet its obligations to the Company.

Aurora Bank, FSB, formerly known as Lehman Brothers Bank, FSB, a subsidiary of Lehman Brothers

Holdings Inc., was a party to the Company’s unsecured revolving credit facilities under which they provided

the Company with commitments totaling $215 million as of September 30, 2009. Lehman Brothers Holdings

Inc. declared bankruptcy on September 15, 2008. The Company and the other banks which are a party to the

agreement amended the unsecured revolving credit facilities in the fourth quarter of 2009 to eliminate this

commitment.

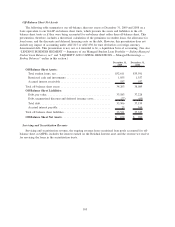

To provide liquidity for future cash needs, we invest in high quality money market investments. At

December 31, 2009, the Company had investments of $32 million with The Reserve Primary Fund (“The

Fund”). In September 2008, the Company requested redemption of all monies invested in The Fund prior to

The Fund’s announcement that it suspended distributions as a result of The Fund’s exposure to Lehman

Brothers Holdings Inc.’s bankruptcy filing and The Fund’s net asset value being below one dollar per share.

We were originally informed by The Fund that we would receive our entire investment amount. As of

December 31, 2009, we have received a total of $460 million of an initial investment of $500 million from

The Fund. In the fourth quarter of 2008, we recorded an impairment of $8 million related to our investment in

The Fund in anticipation of losses on our remaining investment. Subsequently, the SEC granted The Fund an

indefinite extension to pay distributions as The Fund is being liquidated. On November 25, 2009, the court

issued an order providing for (i) the distribution of the remaining assets on a pro rata basis; (ii) an injunction

barring all claims against the fund and any of the defendants; and (iii) the appointment of a monitor to oversee

the distribution and to review any claims by The Fund’s advisor or distributor for management fees and

expenses. On January 29, 2010, the Company received $32 million from The Fund.

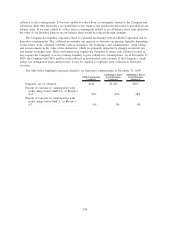

Protection against counterparty risk in derivative transactions is generally provided by International Swaps

and Derivatives Association, Inc. (“ISDA”) Credit Support Annexes (“CSAs”). CSAs require a counterparty to

post collateral if a potential default would expose the other party to a loss. The Company is a party to

derivative contracts for its corporate purposes and also within its securitization trusts. The Company has CSAs

and collateral requirements with all of its derivative counterparties requiring collateral to be exchanged based

on the net fair value of derivatives with each counterparty. The Company’s securitization trusts require

collateral in all cases if the counterparty’s credit rating is withdrawn or downgraded below a certain level. If

the counterparty does not post the required collateral or is downgraded further, the counterparty must find a

suitable replacement counterparty or provide the trust with a letter of credit or a guaranty from an entity that

has the required credit ratings. Failure to post the collateral or find a replacement counterparty could result in

a termination event under the derivative contract. The Company considers counterparties’ credit risk when

determining the fair value of derivative positions on its exposure net of collateral. Securitizations involving

foreign currency notes issued after November 2005 also require the counterparty to post collateral to the trust

based on the fair value of the derivative, regardless of credit rating. The trusts are not required to post

99