Sallie Mae 2009 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2009 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

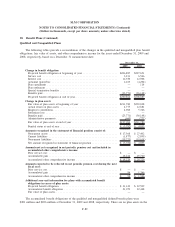

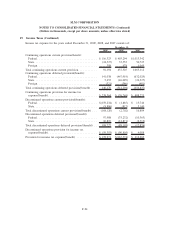

19. Income Taxes (Continued)

Accounting for Uncertainty in Income Taxes

New provisions under ASC 740, “Income Taxes,” pertaining to the accounting of uncertainty in income

taxes, were adopted on January 1, 2007. As a result of this implementation, the Company recognized a

$6 million increase in its liability for unrecognized tax benefits, which was accounted for as a reduction to the

January 1, 2007 balance of retained earnings. The total amount of gross unrecognized tax benefits as of

January 1, 2007 was $113 million.

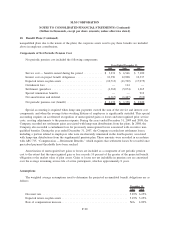

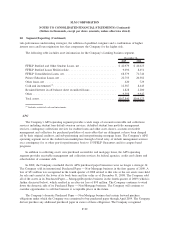

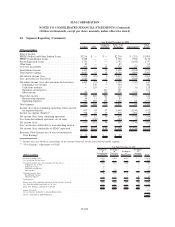

The following table summarizes changes in unrecognized tax benefits for the years ended December 31,

2009, 2008 and 2007:

(Dollars in millions) 2009 2008 2007

December 31,

Unrecognized tax benefits at beginning of year ................ $ 86.4 $ 174.8 $113.3

Increases resulting from tax positions taken during a prior period .... 75.2 11.3 86.5

Decreases resulting from tax positions taken during a prior period . . . (58.3) (132.2) (30.0)

Increases/(decreases) resulting from tax positions taken during the

current period ........................................ (22.5) 36.2 .3

Decreases related to settlements with taxing authorities............ (17.9) (.1) (30.0)

Increases related to settlements with taxing authorities ............ 44.7 — 42.3

Reductions related to the lapse of statute of limitations ............ (3.2) (3.6) (7.6)

Unrecognized tax benefits at end of year..................... $104.4 $ 86.4 $174.8

As of December 31, 2009, the gross unrecognized tax benefits are $104 million. Included in the

$104 million are $17 million of unrecognized tax benefits that, if recognized, would favorably impact the

effective tax rate. In addition, unrecognized tax benefits of $2 million are currently treated as a pending refund

claim, reducing the balance of unrecognized tax benefits that, if recognized, would impact the effective tax

rate. During 2009, the Company adjusted its unrecognized tax benefits to incorporate new issues that were

identified while completing the 2008 U.S. federal income tax return, as well as adjusting the 2003-2007

unrecognized tax benefits to incorporate the net impact of IRS and state tax authority examinations of several

of the Company’s income tax returns. New information was received from the IRS during the first quarter as

part of the IRS examination of the Company’s 2005 and 2006 U.S. federal income tax returns, and the IRS

issued a Revenue Agent’s Report (“RAR”) during the second quarter of 2009 ultimately concluding this exam.

During the third quarter of 2009, the IRS concluded the examination of the 2003 and 2004 U.S. federal

income tax returns of an entity in which the Company is an investor, and the Virginia taxing authority

concluded the examination of the Company’s 2005 through 2007 income tax returns. Several other less

significant amounts of uncertain tax benefits were also added during the year.

The Company recognizes interest costs related to unrecognized tax benefits in income tax expense, and

penalties, if any, in operating expenses. The Company has accrued interest, net of tax benefit, of $7 million,

$10 million and $18 million as of December 31, 2009, 2008 and 2007 respectively. The income tax expense

for the year ended December 31, 2009 includes a reduction in the accrual of interest of $3 million, primarily

related to the reduction of uncertain tax benefits as discussed above. The income tax expense for the year

ended December 31, 2008 includes a reduction in the accrual of interest of $8 million, primarily related to the

reduction of uncertain tax benefits as a result of new information received from the IRS as a part of the

2005-2006 exam cycle for several carryover issues related to the timing of certain income and deduction

items. The income tax expense for the year ended December 31, 2007 includes an increase in the accrual of

interest of $1 million.

F-96

SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)